Chase Sapphire Reserve®: It is a cult favorite, the world’s first viral credit card and one of the best travel credit cards on the market. When Chase introduced it in 2016, it swept the world of credit cards. Since then, despite its sudden and recent increase, it has been endured as one of the best credit cards. $795 Annual fee.

However, that annual fee is effectively offset by the $300 annual travel credit on your card. Here’s what you need to know about this credit and which travel purchases you qualify for: This allows you to make the most of this premium perk.

What is Chase Sapphire Reserve Travel Credit?

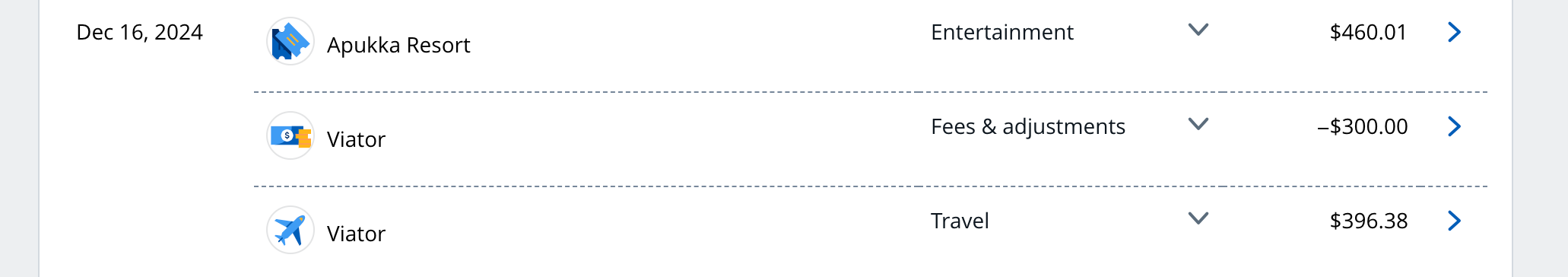

Chase Sapphire Reserve’s $300 annual travel credit is one of the most valuable benefits of the card. This is an advantage of the yearly card, so it’s separate from the welcome offer of cards After spending $5,000 on purchases in the first three months of opening an account, you will earn 100,000 bonus points + $500 Chase Travel Credit.. You earn travel credits annually to be a cardholder and apply to all eligible travel purchases paid with your card. Plus, you might be surprised at how many qualify as a qualifying purchase.

Bankrate credit card writer Ryan Flanigan has had a Chase Sapphire Reserve Card since his debut, and uses it to cover his travel expenses each year.

A $300 travel credit is an advantage of using or loss. If you don’t use it, you will lose any remaining parts of your card account at the end of the anniversary. It won’t roll over. This is the last thing you want to happen, as you won’t get a bonus reward for travel purchases until you use your $300 travel credit. However, as soon as you open an account, you are free to use full credits. So it will be available immediately.

How do you earn Chase Sapphire Reserve Travel Credits?

Every year’s travel credits are reset annually. However, unlike similar credits on top-tier travel cards, it’s like up to $200 on board airline fares. American Express Platinum Card – Timing is based on the card’s renewal date, not the calendar year.

Chase Sapphire Reserve credits are easy to use as they are not bound by any particular airline or travel provider. For example, using Amex Platinum annual travel credits requires committing to one airline at the beginning of the year. Additionally, if your travel plans change, you cannot switch later.

If you already have a Chase Sapphire Reserve, you may have already used at least some of your travel credits. However, if you are unsure where you are standing, log in to the Chase Ultimate Rewards portal and check the dashboard. You can also check when your travel credits are reset. This allows you to plan your purchase accordingly and make sure some are not unused.

What counts as travel credits

One of the best parts of this travel credit is that Chase’s Travel Rewards category includes (but is not limited to) a wide range of purchases.

- flight

- Car rental

- Hotels and motels stay

- cruise

- Eligible Discount Travel Sites

- Public transport such as trains, buses, taxis and more

- Toll bridges and highways

- Parking and Garage

- Timeshare

- Travel Agent

Things that don’t count as travel credits

Unfortunately, not all travel-related purchases are eligible for a refund under this credit. For example, general airline fees such as in-flight purchases are not counted.

Here is a list of ineligible purchases for $300 travel credits:

- Products and Services in Flight

- Onboard Cruise Line products and services

- Tourist activities, excursions, tourist attractions

- Merchants in hotels and airports

- Educational merchant arranges travel

- RV and Boat Rentals

- Public campsite

- Merchant rents vehicles for transportation purposes

- Real Estate Agent

- Gift Card

- Merchant selling points or miles

For more information about the Chase Travel Rewards category, see the Sapphire Reserve Card Terms and Conditions.

How do I redeem my Chase Sapphire Reserve Travel Credit?

Thankfully, redeeming a $300 travel credit is just as easy as swipe your card, just as usual. Chase automatically issues statement credits equal to the amount of all eligible travel purchases made on Chase Sapphire Reserve (yes, it’s really easy). Usually, travel purchases and corresponding credits are posted to your account on the same day. You should see it reflected in the statement within one or two billing cycles.

Please note that if you make a qualifying transaction within one year period but post after that period has ended, your statement credits will count towards your $300 travel credit benefits for the following year.

How to Maximize Chase Sapphire Reserve Travel Credits

First, don’t waste your $300 annual travel credits. Chase Sapphire Reserve has a large amount $795 Annual fee. So, if the card has value, you can narrow it down as much value as possible. Using the full travel credits will help you recover less than half of the cost of storing your reserve in your wallet.

Combine it with the benefits of other cards

Make the most of your Sapphire Reserve Card and its $300 travel credits by combining it with other valuable card perks.

- Hang in the Priority Pass or Chase Sapphire Reserve Airport Lounge before flying

- Apply for Global Entry, TSA Precheck, or Nexus Fee Credit

- Statement Credits from January to June, $250, and $500 per year on prepaid, edited minimum booking for 2 nights

- $300 a year meal credit

By stacking your profits, you will squeeze all the drops in value from your spare card and will be worth the annual fee.

Use your travel credits as soon as possible

It makes sense to want to save on travel credits for special trips, just like earning a mountain of points from the welcome bonus. However, even if you have upcoming holidays on your calendar, I’ll still point to spend $300 as soon as possible, both when you first sign up for your card and when you reset your account anniversary credits. You won’t be able to earn travel-related bonus rewards until you run out of credit, so you can miss out on boosting travel purchase rewards by waiting for use.

That said, if you’ve already fully used your $300 credit and your card member anniversary is right there, I recommend you refrain from purchasing previous qualifying trips and counting it on your travel credits for next year.

Get creative with travel credits

There is no correct way to use travel credits. We recommend using your credits as soon as possible so you can earn bonus points on your trip. There are several good ways to earn credit. You can also travel, book a future trip or stay at a nearby hotel. Alternatively, you can spend your credit on transportation in your area. Here’s how Flanigans can use their $300 travel credits:

“If you have a hotel planned on a property that doesn’t allow you to use points, I’ll save it for that reservation. I’ve used it for train trips outside the US in the past. Airport parking is always one of my biggest expenses on many of the trips I take.

– Bankrate credit card writer Ryan Flanigan

Double check to buy qualifications

If you’re struggling to break the $300 threshold, you can check if your purchase is eligible by being familiar with the merchant category code, or MCCS. MCC is a four-digit number used to classify the products and services of a business. This is how Chase tracks your credit card rewards.

Sometimes, a purchase you think should qualify for credit or bonus rewards is not the other way around (and vice versa). For example, many airports are owned by government agencies. So, we might assume that parking fees are coded as travel, but instead may be classified as “government services.” You may be able to refer to the Visa Merchant Data Standards manual to search for MCCs for your business and know in advance whether a particular purchase is eligible.

Conclusion

Frequent travelers can find many reasons to love Chase Sapphire Reserve, including an annual travel credit of $300. It is also one of the most flexible credits available of all luxury travel cards.

If you can make the most of your Chase Sapphire Reserve $300 travel credits and other valuable card perks, you should be able to earn it if you include up to $120 credits in your Global Entry, TSA Precheck or Nexus and Thining Credits statement credits. $795 Annual fee.