Capital One has retired from the name “Purchase ERASER,” but can redeem the reward and effectively “eliminate” eligible travel purchases from credit card statements. This article has been updated to describe the currently resigned, unnamed process.

Capital One officially retired from Capital One Purchase Eraser a few years ago. But the only good news is the name it rode at sunset. In fact, Capital One allows cardholders to use their rewards to wipe out (or “eliminate”) eligible travel purchases from credit card bills. Naturally, this feature is the main reason why Capital One travel credit cards are so popular.

With a travel credit card from this issuer, you have the option to travel Capital one mile to a one mile airline and hotel program, purchase through the issuer’s travel portal, or cover travel purchases charged to your credit card.

Erasing your purchase is an attractive option for those who don’t want to deal with complex loyalty programs or “stuck” their trip based on award availability. Fortunately, Capital One solves the problem by making redemption easier to understand.

More on using a mile of capital to erase travel purchases

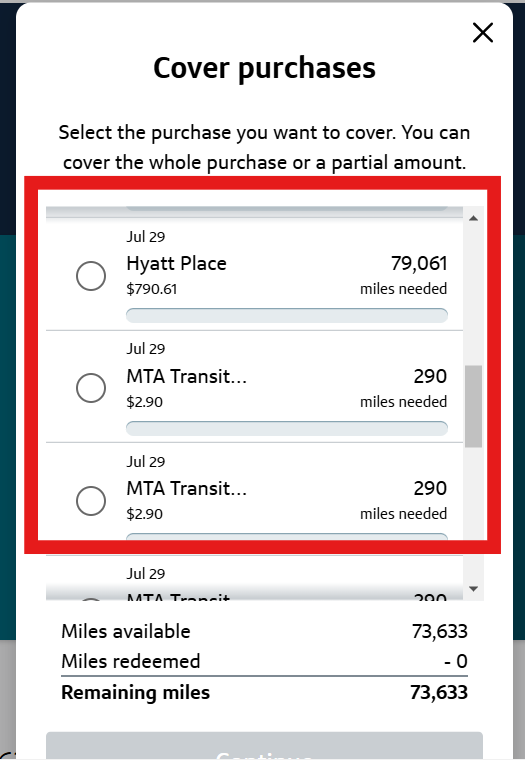

Capital One allows you to actively “eliminate” travel purchases that have been charged to your card within the last 90 days. It’s easy to see how convenient it is when comparing this redemption option to other travel programs offered by competing credit cards. Instead of winning awards on airlines and hotel programs, you simply use your credit card to pay for the travel you need. After the fact, you will use your capital for a mile to “eliminate” all or part of your purchases.

This feature also allows you to book trips with miles you haven’t earned yet. Imagine for a while you’re about to win a welcome bonus Capital One Venture Rewards Credit Cardit is:

- If you spend $4,000 on a purchase within the first three months of opening an account, you earn 75,000 miles

In that case, you can charge your card to purchase within the required time frame (including travel expenses), earn a welcome bonus, and use your miles to capitalize on elimination of trips made within the last 90 days.

Additionally, you can redeem miles at any stage using this method. This means you can use a mile of the capital and get a $3,000 vacation package or a $12 taxi. The redemption rules are very flexible so you can use miles in small batches or save them to cover large amounts of travel purchases at once.

How to erase travel purchases with one capital card

Capital One offers several options to use rewards to offset travel purchases, such as purchasing trips with points through the Capital One Travel Portal or transferring points to Capital One’s Travel Loyalty Partners. However, the easiest and most flexible option is to erase travel purchases from the statement.

Start by logging in to a Capital one account via the desktop, mobile app, or calling Capital One Rewards Center. You should also be aware that this redemption option is only available for travel purchases for the last 90 days, and make sure you have travel purchases to cover your rewards.

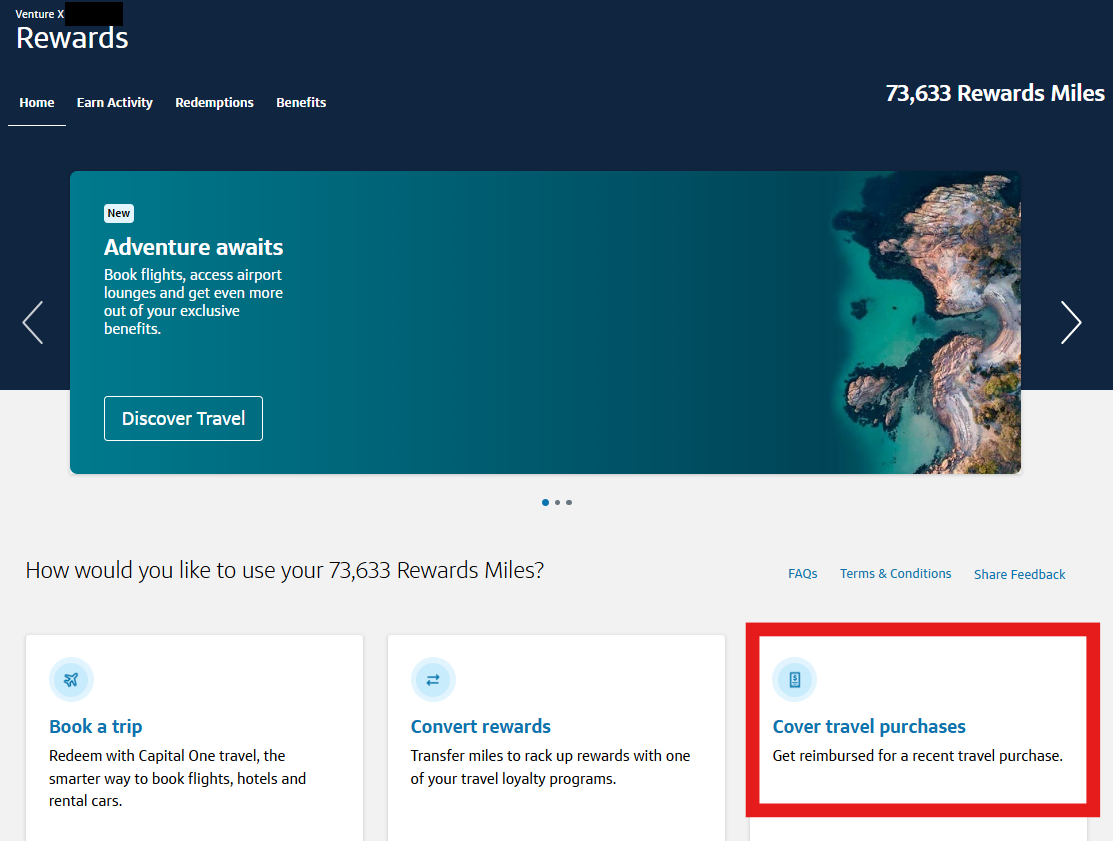

Step 1: Go to the Rewards section of your account. Click (View Rewards)

Step 2: Select “Cover Travel Purchases” from the options.

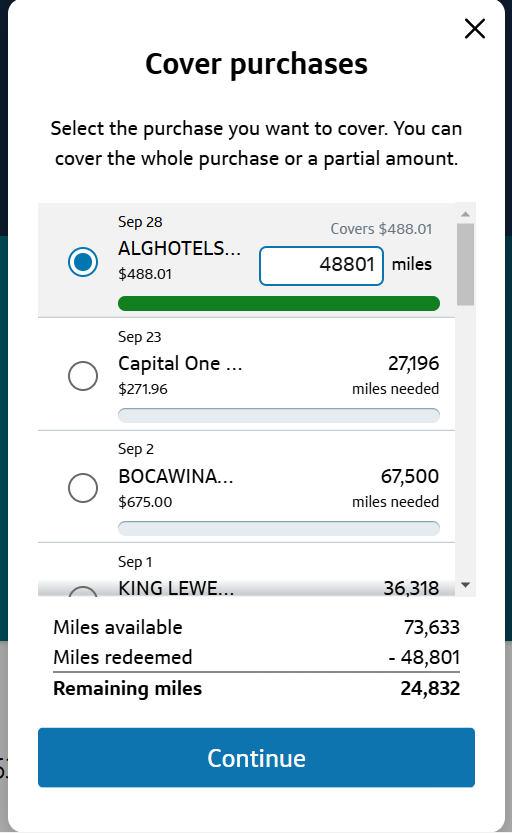

Step 3: Click on the travel purchase you plan to redeem your miles and decide how many miles you want to redeem. If you don’t want to, don’t forget that you don’t need to use all the miles. Once you have settled at the amount you want to spend, click (Continue).

Step 4: Wait for your credits to appear on your account. Once you have successfully redeemed miles for a trip purchase, all you have to do is wait for the purchase to be “eliminated” from your statement.

What purchases can be considered “travel” and erased?

Generally speaking, most travel purchases charged to your card are eligible to be erased using your miles. Everything from expensive hotels to daily shipping costs is qualifying.

As cards that offer this feature are aimed at people traveling, most consumers have focused on using one mile for travel purchases that are traditionally difficult to cover with other travel rewards. for example:

- Disney Vacation. Consumers often use a mile of capital to pay for condos and timeshare rentals near Disney Resorts. You can also use a capital mile to get there by paying for airfares and car rentals. Additionally, when you purchase tickets for the park through travel sites like masked tourists, they are coded as “travel” purchases, so you can use your miles to cover your tickets. If you purchase directly from Disney, your ticket is not qualifying as it is considered “entertainment” in that case.

- Home Share Rental. Airbnb or VRBO rentals are another category where using miles from a Capital One Travel credit card is common. You can cover condo rentals with miles, but other travel credit cards often do not offer this option.

- cruise. Covering a cruise with rewards is notoriously difficult, but your capital can cover all or part of the cruise thanks to the credit options in this statement.

- Vacation Packages. If you would like to book your vacation package through third parties such as travel agents or discount sites such as Expedia.com, you can use your miles to erase your costs.

What is the value when redeemed for credits in a travel purchase statement?

Miles are worth 1 cent each when redeemed for statement credits to cover travel purchases.

Between travel credit cards, achieving a mile per mile value is very typical, but you may have a hard time earning enough miles for premium airfares and luxury travel at this rate.

“Eliminate purchase” vs. Statement Credit: Are there any differences?

Technically, “Erase a Purchase” means the same as getting a statement credit to cover purchases to your credit card account. Please note that with Capital One rewards, you cannot “eliminate” purchases alone. To qualify, you must qualify as a travel purchase. Luckily, Capital One has a broad definition of “travel.”

Which cards allow the cardholder to erase the purchase?

The following Capital One Credit Card offers the option to redeem miles for statement credits to cover travel purchases.

Consumer Card:

business card:

Conclusion

If you’re using Capital for a mile to pay for your next vacation, the first step is to sign up for a qualifying credit card from Capital One. From there, you can earn miles with every purchase. Once ready, you can conveniently use Capital One to “eliminate” qualifying travel purchases from your credit card bill.

Also, please note that some Capital One Travel credit cards allow you to transfer your miles to eligible airlines and hotel partners. You can also redeem your reward for purchases made via Amazon.com or PayPal.

With all these options, this reward program should not be “stuck” with miles that are unavailable.

*Information about Capital One Spark 1.5x Miles Select cards is collected independently by Bankrate. Card details have not been reviewed or approved by the card issuer.