Free membership, free hotel stays, and membership fees at thousands of hotels around the world – what do you not like about the IHG One Rewards program?

If you’ve traveled with the Intercontinental Hotels Group (IHG) brand from Holiday Inn to Crowne Plaza, it’s definitely worth taking part in the rewards program. You can also apply for an IHG One Rewards credit card that seeks more benefits, such as sign-up bonuses and opportunities without a 4 night. But to truly understand whether the program is right for you, it all comes down to the value of the points.

How much is the value of IHG points?

Although the exact values for reward points on IHG One vary, Bankrate’s latest point rating is calculated at 0.7 cents per point.

| IHG Number of reward points | Approximate values | ||

| 5,000 IHG points | $35 | ||

| 10,000 IHG points | $70 | ||

| 25,000 IHG points | $175 | ||

| 50,000 IHG points | $350 | ||

| 80,000 IHG points | $560 | ||

| 100,000 IHG points | $700 |

To calculate the value, you split the cost of a hotel booking in cash (including taxes and fees) with points costs. Other factors that may affect the value of your points include membership status, cost of purchasing more points, cancellation or change fees, location of stay, date and type.

You should also know that our point ratings represent the average. If you have the flexibility to choose your destination, date and hotel, you can find better points. In other words, how much value you get from the IHG One Rewards program depends on how you ultimately redeem them.

IHG How do I redeem one reward point?

IHG One reward point can be used for partner trading, but the best way to redeem them is staying at a hotel. So how many IHG points do you need for a free night?

Point values vary depending on factors such as room availability, date selected, property type, and more. One reward night costs just 5,000 points. You can also book a hotel with a combination of points and cash. Other redemption options are:

- Sporting event, VIP passes concerts, celebrity meets and experiences like greets

- Shopping or gift cards

- Digital rewards such as magazine subscriptions and e-books

- Donations to Charity

- Transfer to airline partner

Determine one reward point value for IHG

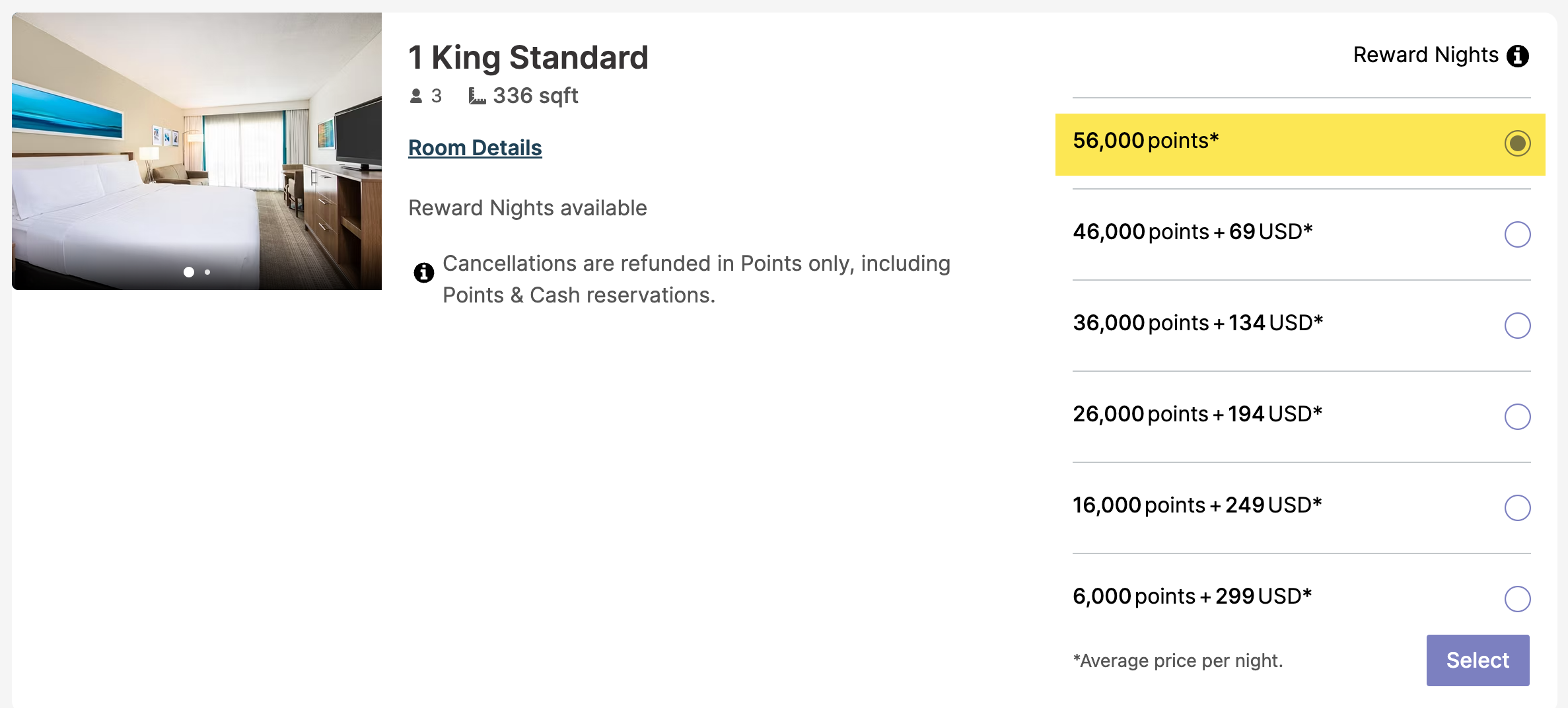

To get ideas for IHG One Rewards Point Value, consider several different properties, the nightly rate, and the number of points you will need for your stay. The first example is Holiday Inn Resort Aruba-Beach Resort & Casino. This is available for $462 or 56,000 points per 56,000 points on some dates in 2026.

Running the numbers means that the average point value for this redemption is 0.83 cents per point, which is above average according to the bank rate rating.

- $462/56,000 points = 0.0083

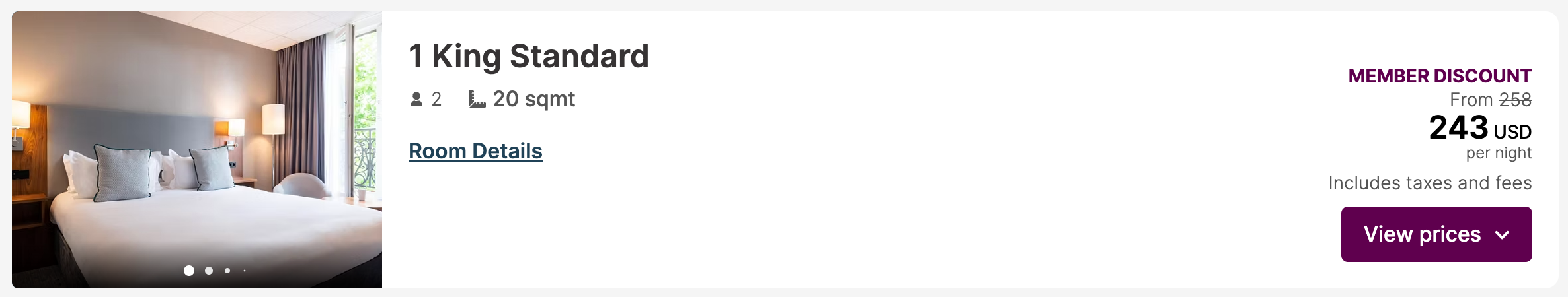

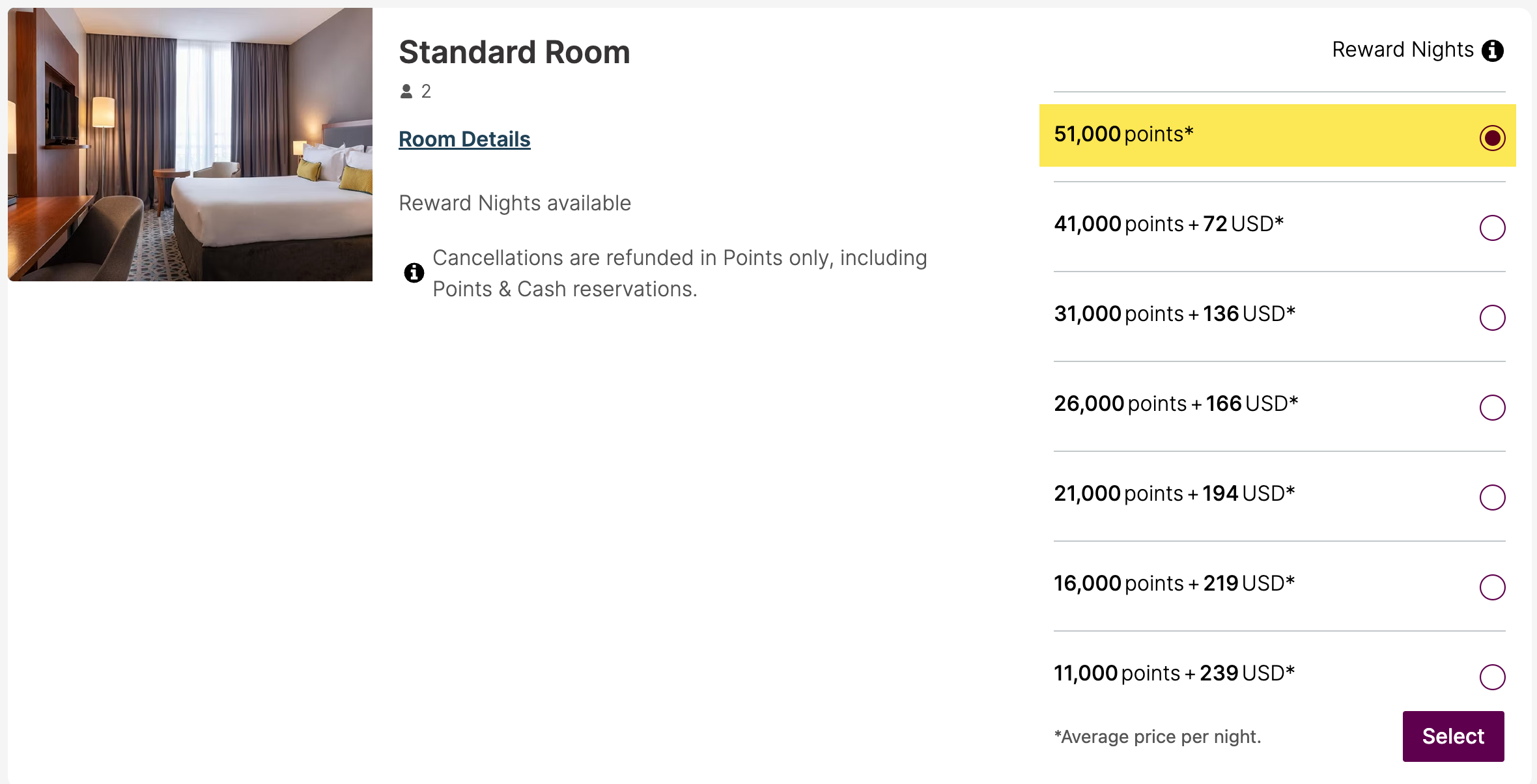

Now consider your stay in Paris, France in April 2026. This hotel is available for USD 243 or 51,000 points per night on select dates.

If you do math for this redemption, you will see that each point is worth about .48 cents each, well below the bank rate average.

- $243/51,000 points = 0.0048

These are just a few examples of how valuable a single reward point is. They also show that some redemptions are more valuable than others. Luckily there are several ways to get more value for each point you redeem to stay with the brand.

IHG How to Maximize One Reward Point

If you want to make the most of your IHG One reward points, make them strategic. You’ll also want to know which benefits and promotions will help you get better redemption value overall. Consider these strategies:

Take advantage of our free night certificate

Some IHG One reward credit cards come with a free night certificate that will help you gain more points. For example, the IHG® OneRewards Premier Credit Card* offers a free anniversary night worth up to 40,000 points on each card member’s anniversary. IHG One rewards premium business credit cards* for small businesses.

Having a co-branded IHG One Rewards credit card will also help you earn Hotel Points with every use you. This means you can work on earning rewards without paying hotel stays and earning enough points for your dream trip.

Book at least 4 nights at at least one property

Having an IHG One reward credit card is eligible for the hotel brand’s “3 night redemption and 4th night free.” This perk works accurately on the front. If you book four nights in a row at the facility, the fourth night is free.

Be flexible with your travel dates

Make sure you are as flexible as possible with your travel dates and destinations. Award nights at IHG hotels allow you to spend more points from one day to the next. This means you can save rewards if you don’t mind moving the dates on your trip.

How do IHG points compare to other hotel reward programs?

The value of IHG Points is comparable to many popular hotel brands like Marriott and Hilton. Check out the average bank rate point values for some of the popular hotel loyalty programs.

Are IHG Points worth membership?

The IHG One Rewards program is free to participate. If you are already a fan of many global brands, there is no drawback to participating in the membership program. You can also earn even more points by carrying one of your IHG reward credit cards.

IHG One reward point can expire if you are not an elite member, so don’t forget to earn or burn points for 12 months. You can keep your points active by reaching the Elite Status Tier with IHG One rewards, booking hotel stays, buying points, donating points, and completing other qualifying activities.

IHG One rewards the elite status layer

If you participate in IHG One rewards, you will be considered a club member. This has basic benefits such as member rates and there is no nighttime power outage date for rewards. The more points and nights you stay at IHG hotels or resorts, the more benefits you will benefit.

There are four status levels that you can achieve.

- Silver Elite: Unlocks this entry-level status throughout 10 eligible nights on the selected IHG property. Perks include free internet, late check-out and 20% bonus points. Please note that you use your IHG One Rewards Traveler credit card* to obtain automatic silver elite status.

- Gold Elite: 40,000 IHG win one reward point or 20 qualifying nights to reach this level. In addition to the benefits of Silver Elite, Gold Elite status allows you to roll over the night towards next year’s status and 40% bonus points.

- Platinum Elite: Earn 60,000 reward points or 40 qualifying nights to reach Platinum Elite status. You can also earn automatic Platinum Elite status with your IHG One Rewards Premier credit card. Platinum status comes with a discount on reward nights, guaranteed room availability, early check-in, free upgrades, select points, or drinks/snacks as welcome amenities at check-in.

- Diamond Elite: Diamond Elite status is awarded after earning 120,000 reward points or after earning 70 qualifying nights. Diamond Elite offers the most bonus points with 100% extra revenue. This means double your points on every purchase. Additionally, adequate notice guarantees room availability. In addition to the platinum perks, Diamond Elite comes with exclusive customer support and a selection of breakfast, points, or drinks/snacks as a welcoming amenity at check-in.

If you are already staying at an IHG hotel and want to achieve these reward levels faster, you can give a boost by combining your reward club membership with your hotel credit card. Both IHG Premier and Traveler credit cards earn extra points per dollar spent on the IHG brand and stack points on your status level.

Additionally, IHG is a Chase Ultimate Rewards partner, so you can transfer rewards earned with a qualified Chase credit card to your IHG One Rewards account.

Conclusion

If you are staying at an IHG hotel more than once a year, it is worth taking part in this free program. However, the most valuable value from this membership will allow you to earn bonus points with a high member status level. IHG One can stack points on credit card holders and reach those levels even faster.

Above all, you’ll take extra time and redeem your reward for four nights, truly maximizing the value of your reward.

*Information about IHG® OneRewards Premier Credit Card, IHG® Rewards Premier Business Credit Card, and IHG® OneRewards Traveler Credit Card Collected independently by Bankrate.com. Card details have not been reviewed or approved by the card issuer.