Making a hotel reservation was once easy. I found a hotel I liked, chose a reasonable nightly tax rate, and paid after checking all taxes and fees. It’s a little more complicated now, and the properties are charged separately with additional resort fees.

Resort fees are just one of many annoying travel fees to jack up Cost of your vacationsome travelers claim they are unnecessary and not noticeable. These fees are supposed to cover Mil-of-of-a-Mill amenities in several properties, including hotel gym access and Wi-Fi in some properties, as well as use of beach umbrellas, pool towels, welcome drinks, and more. Some argue that these amenities should be included in the cost of the room, but that’s not the case. Also, more hotels are adding them as a way to increase revenue without increasing indoor rates.

During a multi-night stay, resort fees can range in the form of hundreds of dollars, in addition to room rates and other expenses. However, when it comes to resort fees, you don’t need to be at the mercy of a hotel. There is a way to avoid these Awkward fees And leave your travel budget as is. Below we’ll introduce everything you need to know about resort fees and how to avoid them.

What is a resort fee?

Resort fees usually range from $25 to $60 per night and are charged by hotels and resorts for amenities such as a pool, tennis court, gym, internet access and more. Sometimes it is disguised with alternative names such as “destination” or “city” rates.

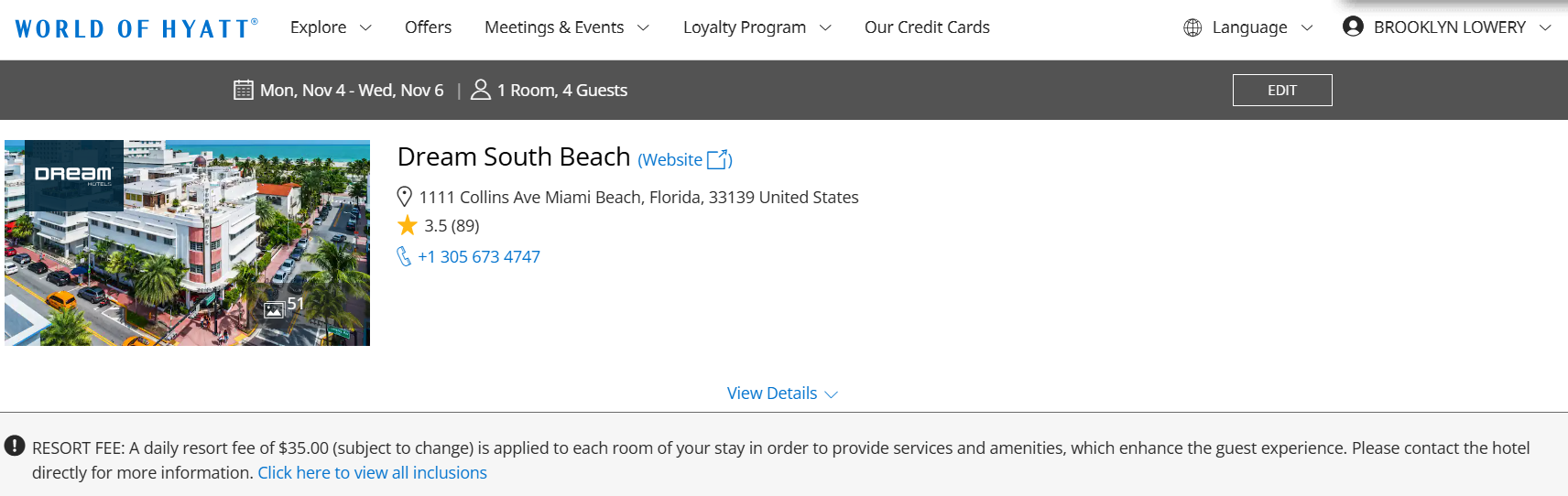

Resort rates are usually listed along with taxes and fees on the hotel booking page. Some properties will show these prices prominently on the room selection page, so guests are aware of what they are paying in advance. However, some resort fees are not disclosed later in the booking process or after check-out.

In particular, many large Vegas hotels are known for charging resort fees. Hotel rooms in Vegas are often inexpensive or compensated, but with a mandatory resort fee of between $30 and $60 per night, hotels generate room income from all guests. Hotels in Vegas that charge resort fees include:

- Caesar’s Palace

- Delano

- Encore

- Excalibur

- Mandalay Bay

In some cases, you will get additional perks at the resort fee. For example, Wynn Las Vegas includes free valet parking in the daily resort fees in the qualifying purchase room. This is pretty close to what most Vegas hotels charge for a valet parking, so valet parking a car could justify resort fees.

However, in most cases the resort fees are not very worth it. As you can imagine, these prices have been controversial among travelers. Resort prices are rising at both city hotels and beach resorts, and the reason for this is not necessarily solid. For example, amenities that should be covered should be included in your nightly room rate. The hotel’s gym and internet access are standard amenities that guests should not pay for.

News Resort Fees

In former President Joe Biden’s 2023 union speech, Biden called for the elimination (or limiting) of “junk” fees, including hidden or unnecessary fees, to be levied on consumers.

Senator Richard Blumenthal and Sheldon White House have accordingly Junk Treatment Prevention Act has been introduced. If these types of fees cannot be ruled out, the law is intended to make fees more transparent so that consumers know what they are paying in advance.

Still, the resort fees stay here – at least for now. Luckily there are ways to avoid you paying for them.

Stay in a hotel that does not charge a resort fee

In many ways you can avoid paying resort fees. Sometimes it’s as easy as picking up a phone, and sometimes it involves a bit of research and advanced planning. No matter which method you use, resort fees can be significantly added during your multi-night stay, so it’s definitely worth a try. After all, why not charge a nice dinner or spa treatment from $25 to $60 per night instead?

The easiest way to avoid resort fees is to stay in a hotel that doesn’t charge. It’s easier than you say, isn’t it? Sites like resortfeechecker.com This process takes time to do:

- Head to the site

- Please enter the name of the hotel

- Get a list of real estate fees including deposits, breakfast, parking, extra bedding, and more

Search City to see a list of real estate along with daily resort fees. This will help you quickly decide which hotel to avoid if you don’t want to pay the resort fee.

Credit cards that abandon resort fees

What if I prefer a hotel with a resort fee? There is no need to compromise on accommodation. I recommend using either of these Best hotel credit card That abandoned resort fee for the hotel you want to stay in. In many cases, this means that you must reach a certain stat or meet the threshold for the rewards you have earned. The two cards you can use to waive resort fees are as follows:

- Hilton honors the American Express Card: Hilton awards the American Express Card and gives cardholders free silver status. This applies to other Hilton Honors credit cards as well. Credit cards will give you free gold and diamond status with a high annual fee.

- Hyatt Credit Card World*: The Hyatt Credit Card World will waive resort fees and destination fees when redeeming free night awards. Additionally, if you stay for 60 nights or earn 100,000 base points in a year to reach globalist status, you will be exempt from a qualified fee and a free night award.

Book your hotel with points

If you are staying at Hilton, Hyatt, or Wyndham, we are pleased to know that you will be exempt from resort fees on bookings for eligible awards (though resort fees may apply and you cannot pay in points). Simply use your points to book eligible rooms and receive a waiver of resort fees. This is a great way to save money on your vacation, as you can save around $40 to $60 per night, as well as getting a free room.

Saving money with resort fees is great, but you need to make sure you can also get the most value from your hard-earned hotel points. Before booking a hotel with points, check the paid fees first. Checking the point rating for each night’s rate (including resort fees) will help ensure you get the most strength in your bag (or hotel points).

Take advantage of elite status

Hotel Elite status can get you Lots of perksfree breakfast, room upgrades, bonus points, and as you guessed, the resort fee was waived. For example, Hyatt will exempt resort fees on eligible reservations (in addition to the free night awards) for Globalist members.

Gaining elite status doesn’t have to be uphill either. For example, Hyatt offers mid-tier discoverer status in the Hyatt Credit Card world, and you can also spend it on top-tier globalist status on your card. In addition to earning five eligible night credits for the next tier status per calendar year, you can also earn two additional qualifying credits for the next tier status for every $5,000 spent on your card.

Of course you’ll want to weigh $95 on your card Annual fees Consider the numerous perks your cards offer to save on resort fees, allowing you to recover your cardholder’s costs through card perks. You’ll also want to weigh your spending requirements and figure out whether it makes sense to put that much of your spend on this particular card to gain globalist status.

Ask for a waiver

If all other roads fail, you can always contact the hotel to see if you want to abandon your resort fees. The motto “Never Ask” applies to virtually any scenario, including getting a resort fee waiver.

You may be able to create a good case as to why hotels shouldn’t charge resort fees. For example, if the hotel pool is closed or the gym is not running, it makes no sense for guests to pay for those services. Or, if you’ve been staying for a short period of time and are not using hotel amenities, it may be worth pointing out as a basis for a resort fee waiver.

You can also point out hotels from competitors that don’t charge resort fees (using the convenient resort fee checker website).

Conclusion

Resort rates must be listed on the checkout page each time you book. Checking the fees means you agree to pay these fees and will not be able to revive unless you cancel your reservation. You can ask your hotel manager for a waiver, but they may not allow it as these fees generate significant income. When hotels create a habit of abandoning them, they lose their income.

Regardless of whether or not, resort fees are the unfortunate costs that most of us encounter while traveling. But they don’t have to get in the way of a great vacation. Incorporate these troublesome fees into your travel budget, Top Travel Card This could offset costs. We will do our best to avoid them entirely by booking hotels that do not charge resort fees or by booking with chains that abandon elite members and award booking fees.

*Information about the world of Hyatt Credit Cards is collected independently by Bankrate.com. Card details have not been reviewed or approved by the card issuer.