Track the ultimate reward It is one of the best travel reward options on the market and for good reason. With the right chase card, points redeemed for a trip are worth at least 1.25 cents when redeemed through the Chase Ultimate Rewards portal. These selection cards also allow you to transfer points to one of Chase’s airlines or hotel forwarding partners. Based on Bankrate’s latest points and miles ratingsChase’s ultimate reward points are worth an average of 2.0 cents if transferred to a highly valued transfer partner.

In addition to transferring to your travel partner, you can also transfer points between certain Chase cards. This is a valuable feature that allows you to move Chase points from cards that don’t offer Chase’s best reward points to one of Chase’s Premier Altimate Rewards cards, giving you the opportunity to pool points on one card, and gaining greater value. Not only can this benefit your own Chase Points account, this option extends to people within your household who are also eligible Chase Cardholders.

Transferring a chase point is a fairly simple process. Here are some things you need to know about chase cards that can move points, how to transfer them, and what you need to know when transferring tracking points is a good idea:

How to forward tracking points

There are only three Chase cards that earn you the ultimate reward points that can be transferred to your airline or hotel partner.

Chase also has other reward cards. This earns like a cashback credit card, usually worth a penny each. With these cards, you cannot transfer directly to Chase Airline or one of the Hotel Partners. However, if you have one of the three ultimate reward chase cards, you can transfer points to that card. These cards include:

Here’s how to transfer points between your account and your travel partner:

In another chase account

If you have multiple chase cards, you can transfer chase points between the cards to combine them. Here’s how:

- You will be taken to the ultimate reward portal where you can check the point balance.

- Select the (Manage Points) drop-down section and click (Merge Points).

- Select the Send and Inbound Chase accounts and the number of points to transfer.

- Click (Next) to check and confirm the amount of point transfers.

- A confirmation screen will appear on the next page. Points are now displayed as transfers occur immediately.

To another tracking cardholder

Perhaps you want to transfer Chase Points to another member of your home Chase Credit Card. According to Chase Ultimate Rewards terms and conditions, recipients must be members of households listed as certified users on their Chase credit cards. Points can be transferred in increments of 1,000. This is similar to transferring a travel point.

When you transfer points to another household member’s account for the first time, you must call the Chase customer service number on the back of the card. Discuss with an agent who wishes to combine the points with another member of your home, and the agent begins the transfer.

Household member accounts are now displayed online in the Ultimate Rewards portal when an agent processes a request. You can now move points between accounts through the same process as above.

For travel partners

Chase offers a dozen or more airlines and hotel partners to choose from with a 1:1 transfer ratio. This means that 1,000 points transferred to a program will be 1,000 points for that program. However, some of these partners actually increase the value of the points when they transfer them to the Partner Loyalty Program. For example, the points you earn from Chase Sapphire, which prefers Chase Sapphire, are worth about 2.0 cents each. However, if you transfer them to Aer Lingus you will earn around 1.8 cents per point.

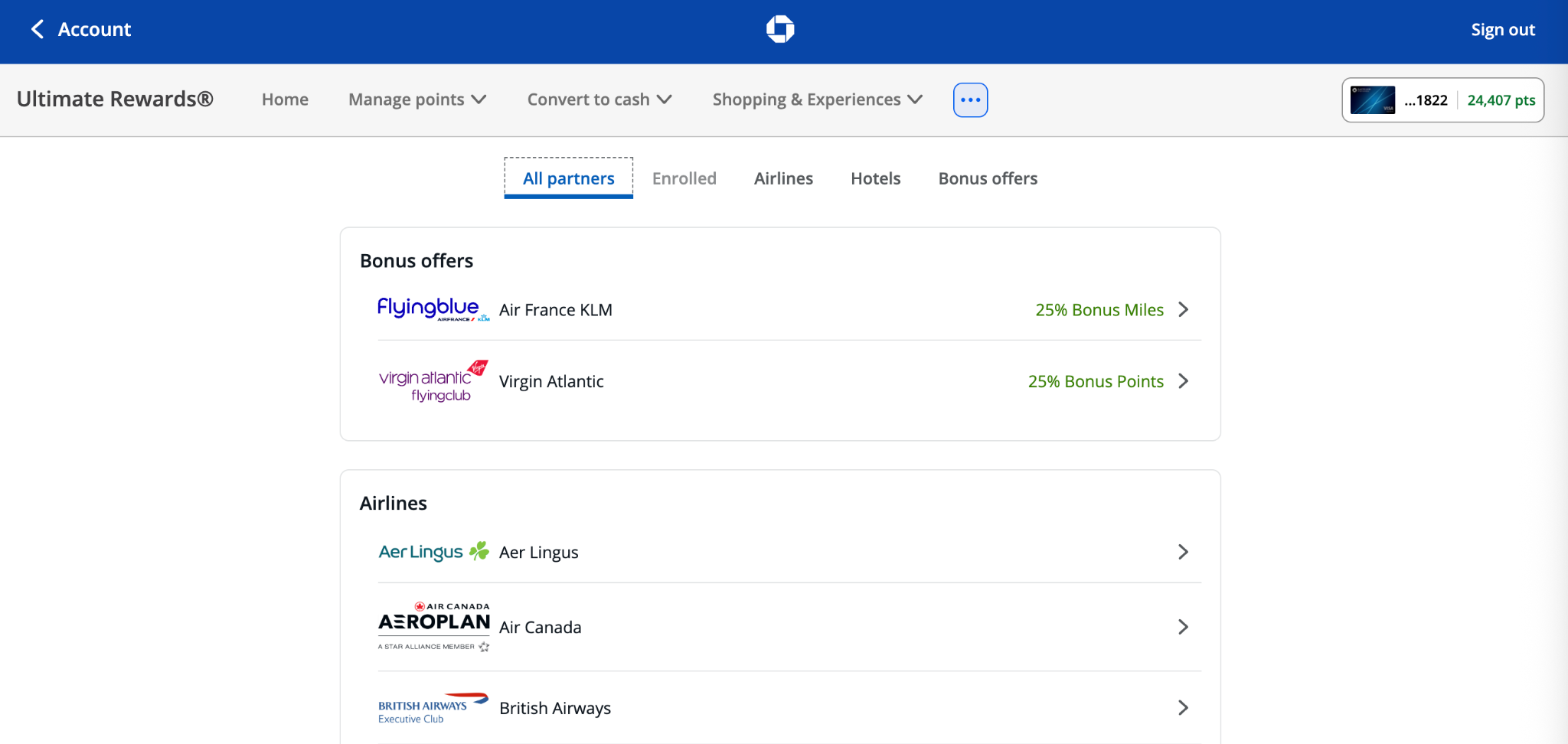

Here’s how to transfer the ultimate reward points to a Tracking forwarding partner:

- Log in to your Ultimate Rewards account and select the Travel dropdown and Transfer Point to Partner.

- Click on the airline or hotel partner to forward to and you will be directed to the partner page. Here you can read point transfer terms and timelines. Click Transfer Points to continue.

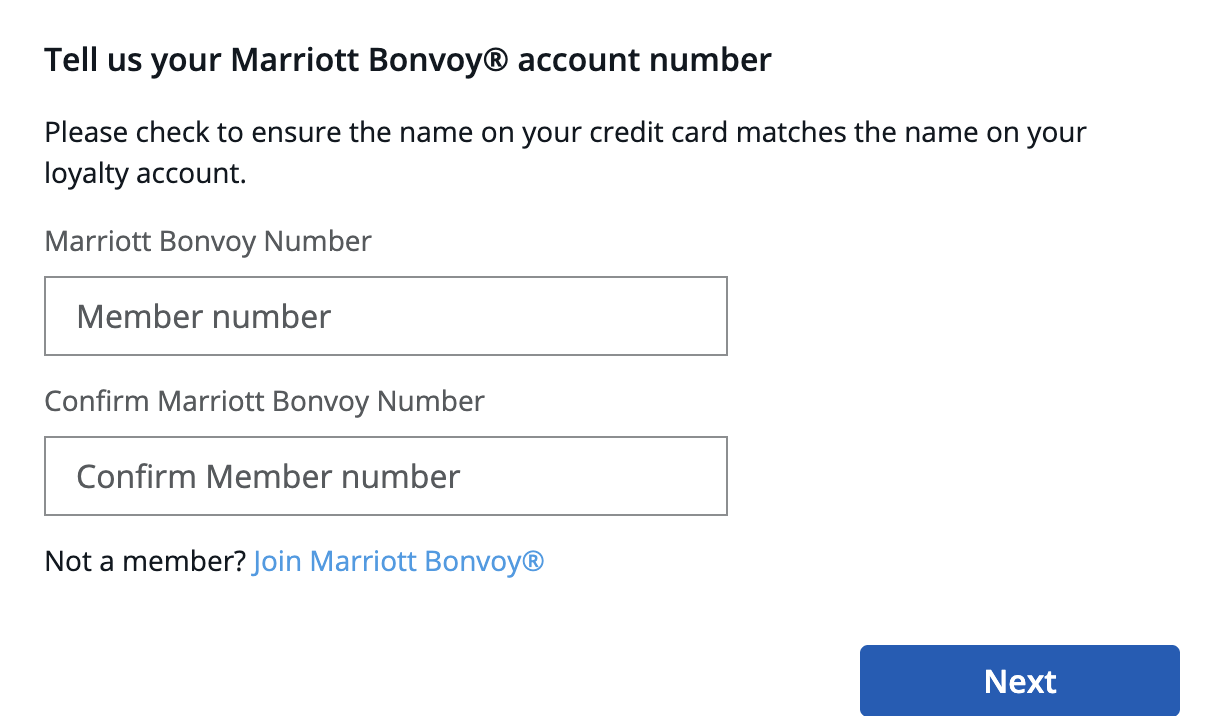

- Enter your partner program loyalty account number and click (Next).

- Finally, enter the number of points you want to transfer to your partner (in increments of 1,000), then “Continue” again, then press “Confirm and Send.”

When to transfer points

There are situations where transfers make the most sense to maximize the value of points.

To convert cashback rewards to ultimate reward points

Transferring points from a chase card that earns only 1 cent worth of non-transferable points to a premium card that earns ultimate reward points is the best way to maximize your reward.

For example, in Chase Sapphire Reserve, if your Chase Sapphire Priority Card increases the Points value to 1.25 cents on the same portal, while being redeemed to pass through Chase’s Ultimate Reward Portal, your Points are worth 1.5 cents. For potentially even greater value, transferring your ultimate reward points to the right transfer partner will help you grow your cashback dollars even further.

When boosting your points for a specific redemption

You may not have enough points for redemption yourself, but if you transfer it to another person’s account in your household, the combination of points may be sufficient for your goal.

When canceling your chase card

If you have multiple chase cards, there may be points that require you to cancel one of the cards. Transferring points from one account to another is a sensible way to avoid losing track of accumulated tracking points. You can transfer it to any other account or members of a designated household.

Should I forward a tracking point?

No matter what chase cards you have, you should consider transferring tracking points, especially if you want the opportunity to add flexibility and redeem rewards for maximum values.

If you have one of the Chase cashback cards, you can earn bonus rewards in everyday areas such as groceries, meals, and drug stores. You can then transfer these points to a chase card that offers the ultimate reward points. The Chase Ultimate Rewards program offers impressive value and allows you to redeem rewards through the travel portal for values that are not often seen in other travel reward programs. It also provides the opportunity to transfer points to another loyalty program. This could add even more value to the points.

Conclusion

Chase Ultimate Rewards Points stand out as the biggest travel reward option due to its value and flexibility. Whether you transfer points between multiple chase cards or use many available travel partners, transferring chase points can significantly increase their value and increase your chances of redemption. Don’t miss the opportunity to make the most of your tracking points and consider transferring them for the best possible redemption options.

* Information about Chase FreedFreed® is collected independently by Bankrate. Card details have not been reviewed or approved by the card issuer.