If your friends and colleagues are always on vacation with credit card points and miles, you may wonder how you can join the game. Luckily, starting a reward for a trip is easy if you have good trust and are willing to make minimal research and planning. Certainly there are ways to truly lift your game and become the finest expert, but no one will start there. That’s fine.

The most important step in the process is to know which travel credit cards you sign up to so you can earn points and miles. From there, you can start dipping your toes into the redemption option.

But what? Types of rewards Can you choose from you? And what is the best way to use your credit card rewards? This guide will help you understand the steps to take first, allowing you to earn and use travel points and miles.

What are points and miles?

It will help you understand the difference between points and miles before you start using travel rewards for flights, hotels, or other types of travel. You also need to know that each type of reward currency has its own Average redemption value Depending on your airline, hotel or credit card rewards program.

Below is an overview of the types of travel rewards available:

- Airline miles and points: Airline rewards come in the form of miles or points, and they are being passed through Co-branded airline credit cards I am affiliated with a loyalty program of a particular airline. Typically, you can exchange airline miles for flights and costs related to flights, such as seat upgrades and check bag fees.

- Hotel Points: Hotel Points are provided through co-branded hotel credit cards affiliated with certain hotel loyalty programs. These points can be redeemed for free (or discounted) award nights within the hotel’s loyalty program, but hotel points have additional redemption options such as gift cards and magazine subscriptions.

- Credit Card Points and Miles: Credit card points (or miles) is the type of reward that is found within the credit card issuer’s reward program. Track the ultimate reward point, Capital 1 mile and American Express Membership Rewards point. These rewards can be moved via statement credits, gift cards, or issuer’s travel portals or transferred to branded airlines and hotel partners.

Important tips before earning points and miles

There are several important credit card rules to follow. Mistakes to avoidWhen opening first Reward Credit Card. Before plunging into the world of points and miles for a trip, consider the following advice:

- I will pay off your card in full each month. Average credit card interest rate It is currently over 20%. With that in mind, if you balance over time and pay interest, you won’t “move ahead” your reward.

- Keep an eye on your credit score. If you use your credit card to always pay your bills on time and always keep your debt levels down, you can improve your credit score. Most experts recommend keeping you up Credit usage rate The best results are below 30%.

- Be realistic about your points and miles goals. Look for a rewards program tailored to your current spending and travel habits, along with your credit card and travel goals. For example, if you don’t have a preferred airline or hotel, you have a general travel credit card that offers transferable rewards. Rewards that do not expire It may help you achieve your travel goals more than airline or hotel co-branded cards.

- Limit the number of cards you apply at once. Don’t go overboard and apply for all the travel rewards credit cards that will catch your eye. If so, you could damage your credit score for too many Difficult enquiries About your credit report.

- Carefully pursue sign-up bonuses. Most travel reward credit cards offer sign up bonuses when you meet Minimum Expense Requirements Within the specified time frame to open an account. These bonuses are useful, but you should only pursue them if you can meet your spending thresholds with your regular planned purchases and invoices.

How to earn points and miles

To start earning rewards, consider one or all of the following strategies:

I use a travel credit card

While you can earn travel rewards by staying at a specific hotel or flying on an airline, travel reward credit cards offer the best value and the most flexible travel reward currency. Plus, they are the fastest path to building a travel rewards bank. That’s because travel credit cards allow you to earn points or miles for every dollar you spend. This means you can earn travel rewards on everything from grocery bills to utility payments to car gas.

largely Top Travel Credit Cards You can also get a big welcome offer in the first few months if you meet minimum spending requirements and other conditions. These welcome offers are usually worth a trip of hundreds to over $1,000 and can provide a great way to quickly reach your initial travel goal. These sign-up bonuses are definitely worth pursuing – as long as you’re aware that you’re not spending too much to win them – try to prevent these offers when choosing your cards.

Sign up for the loyalty program

To start earning points and miles, we recommend signing up for all airline and hotel loyalty programs for the brands you normally use. Luckily, the Travel Loyalty Program is free to join and sign up takes just a few minutes online. This means you sign up for Delta Sky Meal If you frequently fly with the delta, program the same way you sign up for Hilton’s Honor Programs if you are always staying at the Hilton Hotel.

Once you sign up, you can earn rewards with your favorite loyalty program for your travels you already have. After that, once you have enough points or miles, you can unlock different layers of elite status. This comes with your favorite brands and more perks.

Bookings passing through the travel portal

Booking your trip through the credit card travel portal is also wise. This is because it can provide an increase in rewards for every dollar you spend. Just one example is popular Chase Sapphire Reserve® It offers triple points on travel and meals, but increases that by 5 times on flights booked via the Chase Travel Portal. You can also earn 10x points on hotels or car rentals booked through the portal. This is more than three times the ones you get to book the same option elsewhere.

Other credit card portals offered through American Express, Capital One and Citi offer similar transactions when you book a trip with a qualifying travel credit card. Please remember this.

Please use the shopping portal

Airline and hotel loyalty programs typically offer shopping portals available, but there are also card issuer portals that help you earn more rewards. The Shopping Portal allows you to earn additional points or miles by logging in to your account before making a purchase and clicking on the participating retailer offers. Bonus offers vary, but you can usually earn 1 to 5 times more points or miles for each dollar you spend.

Main Credit Card Shopping Portals offered directly through the Issuer or Frequent Flyer Program include:

Do not skip the dining program

Many hotel and airline loyalty programs also offer dining programs that allow you to earn additional rewards. Most of the time, all you have to do to earn points and miles with these programs is to sign up, eat at participating restaurants, and pay meals with a connected credit or debit card. Other regulations can also be applied to earn bonus rewards, such as hitting the minimum spending requirement per meal, but the limits tend to be low (at least $25 per meal for some programs).

Airline and hotel dining programs include:

Beware of spending category bonuses

Maximizing rewards in the credit card bonus category is another way to earn more points and miles over time, and not to do a lot of work. This move is especially important with travel credit cards. Because they tend to have lower reward rates for regular purchases and increase rewards in bonus categories such as food, travel and gas stations.

As an example, City Strata Premium Card It offers more than the standard rate of return for hotels and rentals booked directly booked through city travel, air travel, hotels, restaurants, supermarkets, gas and EV charging stations. You can earn more points over time by using this card to purchase in all these categories rather than in other forms of payment.

How to choose a travel credit card

In front of you Please choose a new credit carddo your homework so you can understand which cards are eligible.

Once you have a good idea about where you stand, it’s time to decide which specific card to apply for. Consider the following:

Popular travel credit cards to consider

There are many travel credit cards that may suit your needs, but the chart below highlights some of the most popular options to check out.

How to redeem points and miles

Ultimately, how you use your credit card points and miles will depend on the travel credit card you sign up for and the reward currency you earn. This is a summary of the main ways to redeem rewards.

Maximize your points using our travel partners

If you choose a travel credit card with transferable points, make sure you learn about the program’s airlines and hotel partners and how they work. You’ll also want to get used to checking award pricing with your partner to see if you can get a better deal, and see what processes are required to actually transfer points to your partner.

Why is this important? With exceptions, you can find better award pricing with your partner than you would pay if you booked via the travel portal or cash. When I searched the World of Hyatt Program for hotels in Cancun, Mexico in September 2025, I found out that I could book The Dreams Jade Resort & Spa for, for example, 17,000 Hyatt Points or $251. Transferring points to Hyatt in this scenario gives you a point rating of 1.47 cents per point.

This is a better value than you would get if you booked this same hotel on Chase Travel (and found the same price) if you prefer Chase Sapphire.

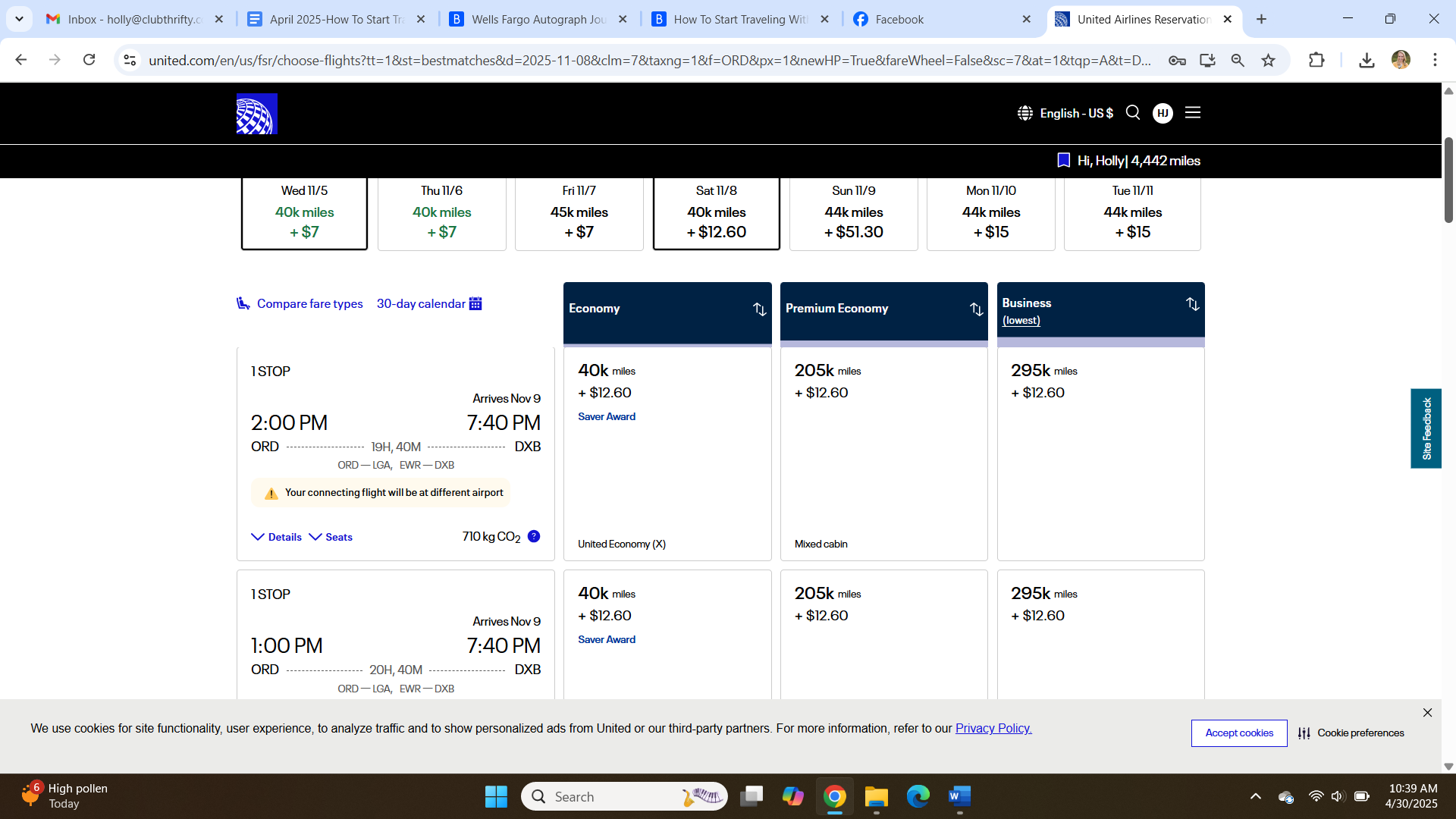

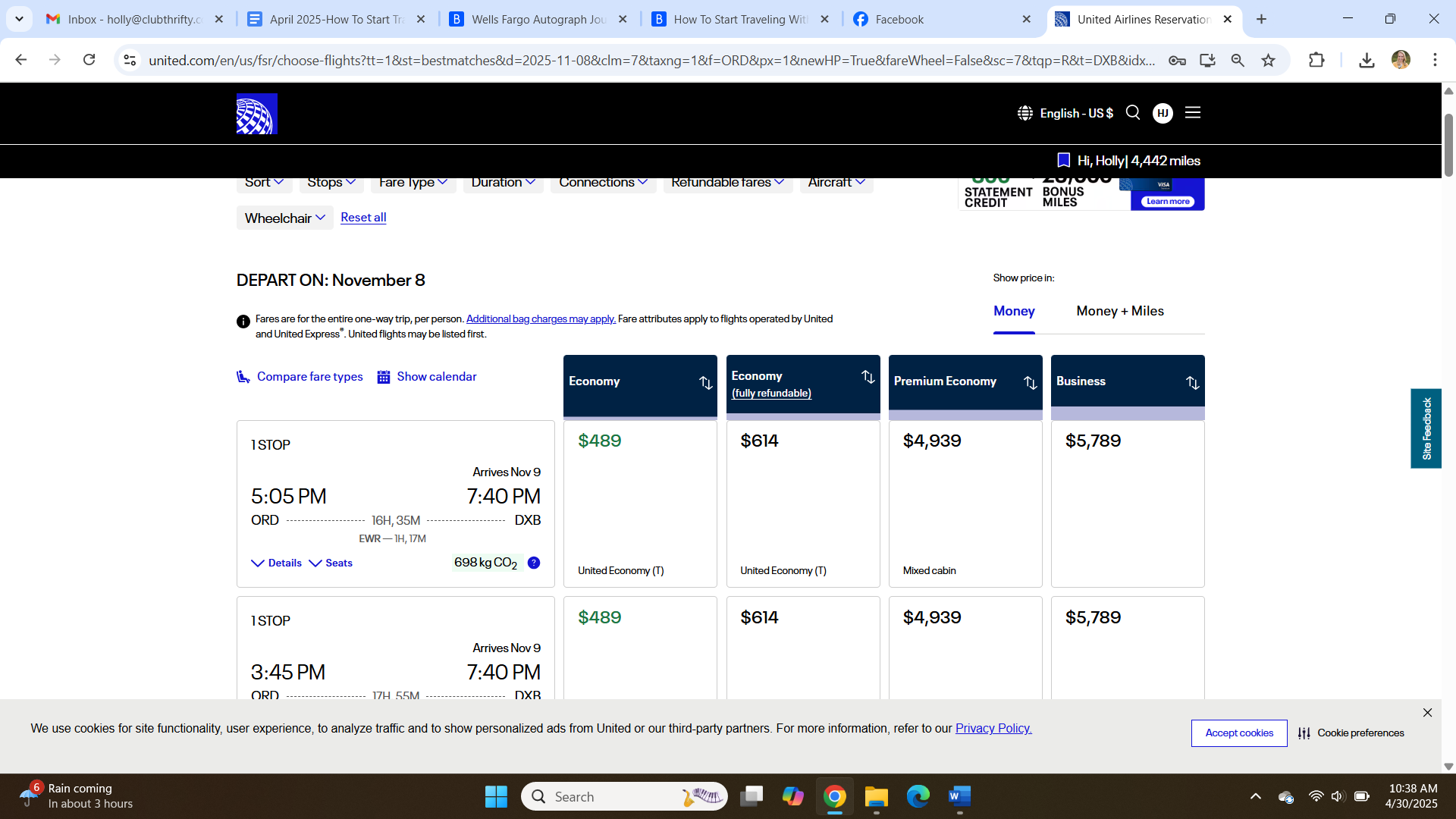

The possibility of better reward value applies to airfares, especially when it comes to premium seats with partners of certain airlines. For example, I found a one-way award flight in business class with United from Chicago to Dubai for 295,000 miles and $12.60. However, the same flight costs $5,789. This is a point value of 1.9 cents per mile.

Conclusion

Reading on complex redemption and multi-card strategies makes it intimidating to make a leap into the world of travel. But it doesn’t have to be that way. Start a single card or loyalty program that fits well with your lifestyle, budget and travel goals. As you become more comfortable with rewards, you can expand your plans and add more complexity.

The key is to understand your own credit history and plans for your travel rewards strategy. Because you use travel rewards wisely, saving small amounts on your next vacation should motivate you to continue learning.