When you take out a secured loan, you allow the lender to place a lien on what you own, or provide funds in exchange for borrowing money. Your assets give lenders extra “security” to pay off the loan. By default, a secured loan allows the lender to acquire the assets and sell them to recover the outstanding loan balance.

Secured loans usually qualify, qualify for low interest rates and have low interest rates, as they are usually less risky to lenders. Knowing exactly what you promise and what you will lose is important before you take out a secured loan.

What is a safe loan?

A secured loan is a debt product supported by the assets you own. When applying for a secured loan, the lender must know which assets to use as collateral.

You can pledge your car, home, or other assets as collateral for a secured loan, and the lender will place a lien on that property until the loan is repaid. By default, lenders can claim collateral to sell to recover the loss.

Most secured loans are installment loans. This means you will receive all your funds at once and make an equal monthly payment until the loan is fully paid. Interest rates are usually fixed, and repayment terms can be as short as 30 years for protected personal loans or for mortgages.

How do a secure loan work?

The process of applying for a protected loan depends on the type of secured loan you need. Mortgages are the most involved, so you need to dig deeper into the employment, assets, credit history, and the value of buying or refinancing.

Cars, boats, and RV loans require less paperwork and often can be approved relatively quickly. A protected personal loan works similarly to a vehicle loan, requiring you to prove the value and ownership history of the assets you are using as collateral for the loan.

During the application process, the lender will check your credit score and estimate the value of your collateral to determine whether you qualify. Before submitting a full loan application, some lenders will allow you to prequalify for the loan for the loan without damaging your credit.

Types of safe loans

Assuming you meet the lender’s eligibility requirements, you may be able to obtain a secured loan using assets of sufficient, verifiable value that you can own. Most safe loans fall into these categories.

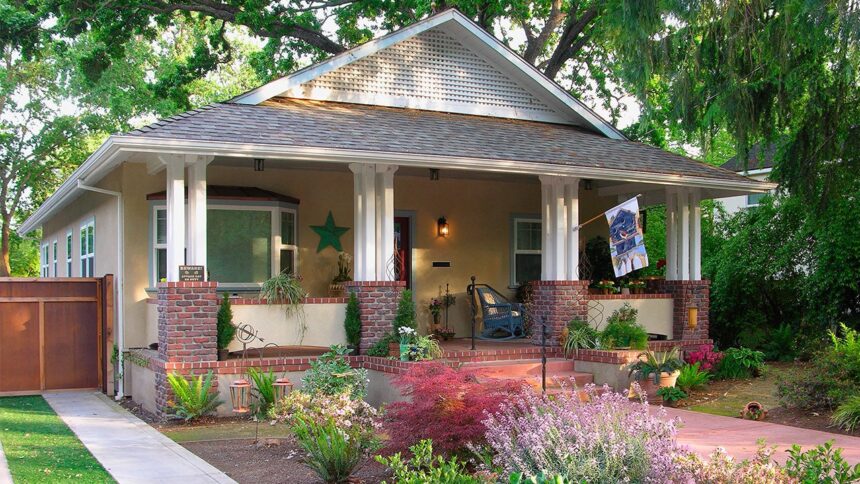

- Mortgage: With a mortgage, you list your home or property as collateral for funding. If you fail to pay as promised, the lender can take you to your home to meet your debt.

- Home Equity Credit Line: Home Equity’s Line of Credit (HELOC) allows you to rent a portion of your home’s equity with a revolving credit line that acts like a credit card. Like a mortgage, HELOC requires you to raise your home as collateral.

- Home Equity Loan: Like HELOC, a home equity loan uses your home equity as collateral. There are the same risks, but the main difference is how you receive your funds. Home equity loans are funded as lump sums.

- Automatic loan: When you receive a loan for your car or other vehicle payments, your car will be used as collateral. If you don’t make the full payment on time, it could be regained.

- 401(k) loan: If you have money transferred to your retirement account through your employer, you may be eligible to oppose some of its value on a 401(k) loan.

- Loans to land: Land loans are used to fund the purchase of land. This type of loan uses the land itself as collateral.

- Business Loan: A secure business loan can be used to purchase equipment, pay wages, or invest in business projects. There are many assets that can be used as collateral, such as inventory, equipment, land and buildings.

Common types of collateral

What you use as collateral depends on whether your loan is for personal or business purposes. Some examples of collateral are as follows:

- Real estate including fairness in your home

- Cash account

- Car, boat, RV, or other vehicle

- Machines and Equipment

- investment

- Insurance contract

- Valuables and Collectibles

Pros and cons of secured loans

A secure loan offers many benefits, including the possibility of low interest rates, but there are also risks.

Strong Points

- You may find it easy to get with a low credit score

- Possibility to get a higher loan amount

- Lower average rate than unsecured loans

Cons

- If you don’t pay off your loan, risk losing your assets

- The value of the collateral determines the amount of the loan

- The application process for secured loans may be longer

Protected and unsecured loans

If you are trying to decide on a secure or unsecured loan, it can be helpful to understand how each one works. Choosing one often depends on how much you need to borrow, what you need, how quickly you need it, and whether you meet the requirements you are eligible.

Safe loan benefits

- Low rates and fees: Usually, you’ll find lower fees on secured loans, as they are less risky than secured loans. For poorly credited borrowers, the unsecured bad credit loan rate could be 36%.

- Larger loan amount: Because secured loans are tied to the value of assets placed as collateral, lenders often have the ability to take out more loan amounts. Unsecured lenders typically limit their loan amount to less than $50,000.

- Longer repayment terms: A secure mortgage will help spread your payments for 30 years. Conditions are usually limited to 1-7 years on unsecured loans.

Unsecured loan benefits

- Faster available funds: Unsecured loans can be funded quickly and quickly within one business day of approval, making it a good choice if you need funds quickly. Some secured loans, such as mortgages, can take up to six weeks to fund them.

- No collateral required: Unsecured loans are a better option if you don’t risk losing your car, home, or other assets due to default. However, there are still consequences for defaulting on unsecured loans.

- More Flexible: Unsecured personal loan funds can be used for almost any legal purpose, from debt settlement to emergency costs. There is no collateral to approve, so the funds you use when necessary are yours.

Protected loans and defaults

By default, a secured loan can begin the process of retrieving assets attached to the loan. It can take several months and lenders may offer a variety of options that will be useful if you have financial problems.

If you lose your assets due to foreclosure or foreclosure, you can borrow money on your liability even if the remanded assets are sufficient to cover the amount of the loan and cannot be sold. Depending on your state, the lender can sue you in court for determining a shortage and create a public record that will remain in your credit report for seven years.

However, it often takes time to sell your home or business assets, so you may have time to catch up with your payments and avoid losing the attached collateral. For example, it could take up to a year for a lender to complete the foreclosure process.

What if I can’t repay a secured loan?

If you find it difficult to pay off a safe loan, there are a few steps.

- Please contact your lender: Contact your lender to discuss your options. Lenders may agree to change loan terms, such as temporarily suspending payments due to new payment schedules, new repayment periods, or loan deferrals.

- Seeking financial help: You can contact a consumer credit counseling agency accredited by the U.S. Department of Housing and Urban Development Approvals or the National Credit Counseling Foundation (NFCC) or the American Financial Counseling Association (FCAA).

- Invoice prioritization: Always focus on paying secured liabilities that can affect your basic needs. For example, if you need to choose to pay for your credit card and car, choose to pay for your car.

Conclusion

A safe loan is a cost-effective financing option when purchasing high-value assets like a car or home. However, before applying for one, you should weigh the pros against their weaknesses.

Unsecured loans may be a better option if you don’t want to risk losing your collateral, but secured loans can be offered at a better rate. No matter what your decision, compare the rates and terms of several lenders to get the best deal for your financial situation.