Americans underwater on car loans are borrowing record amounts, while lenders are retrieving vehicles at rates they haven’t seen since 2009.

These are symptoms, not causes. And the most concerning symptom may be an increase in car loan delinquency rates. According to the latest data from Transunion and April Morningstar analysis, they are 15 years highs among borrowers who have been paying 30, 60 days or even delayed. Additionally, we see numbers elsewhere increasing for each late category for more than 1-3 months.

As expected, poor credit borrowers are seeing the worst. Almost 6% of subprime car loans are at least 60 days behind, the highest number since Fitch Rating began tracking in 1993.

So, what is causing these unprecedented levels of delinquency? And what can restore order to the car loan market?

First, we are monitoring delinquent trends.

Really, this is a full trend. Delinquency is growing among borrowers of all credit scores, income levels and ages, with all types of lenders generating these delinquency loans.

1. Credit scores and delinquents

yes, Subprime borrowers – Generally, consumers with a credit score of 600 or less are most likely to be late in paying for their car loans. However, Transunion data also draws on trend lines for borrowers with better credit.

Mortgage delinquency rates are similar to pre-pandemic levels, but car loan delinquency rates remained increased. Auto loan delinquency rates are broadly based on your credit score and income level.

– Wilbert van der Krauw, economic research advisor for the New York Fed.

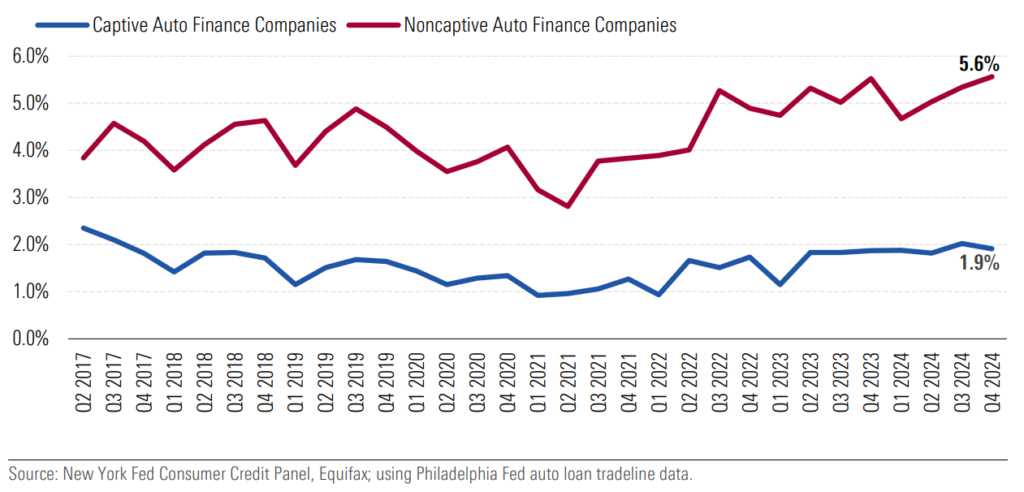

2. Lender Types and Delinquent

The prisoner of war lenders, or the in-house lending division of the automaker, generally attracts high-collet car buyers. Introductory APR Offer. Still, the delinquency rate for loans from this lender type remains stubbornly high compared to the 19 figures before 199.

On the other hand, non-credit car buyers remain favorable over their peers in order to fund the purchase of second-hand (or perhaps new) vehicles using non-captive lenders. So it’s not surprising that delinquency is rising most rapidly in this type of lender, staving pre-pandemic levels.

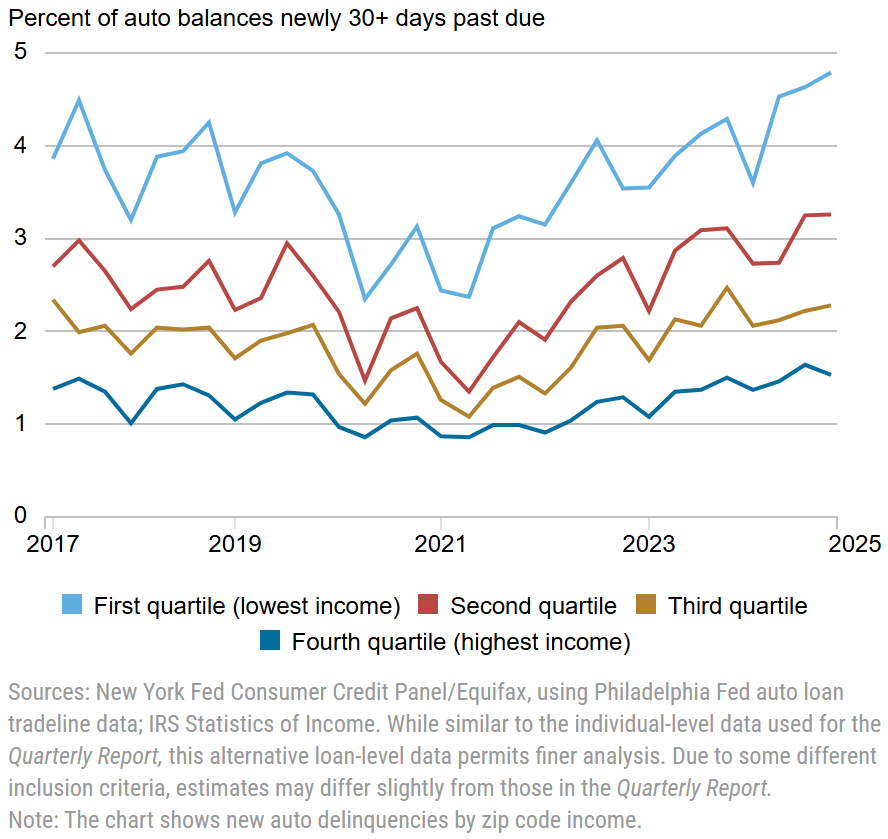

3. Income Level and Delinquency

Just as borrowers with the lowest credit score are more likely to fall behind on their debt, so are borrowers with the lowest income levels. But even the high-revenue groups are lagging behind their monthly membership fees.

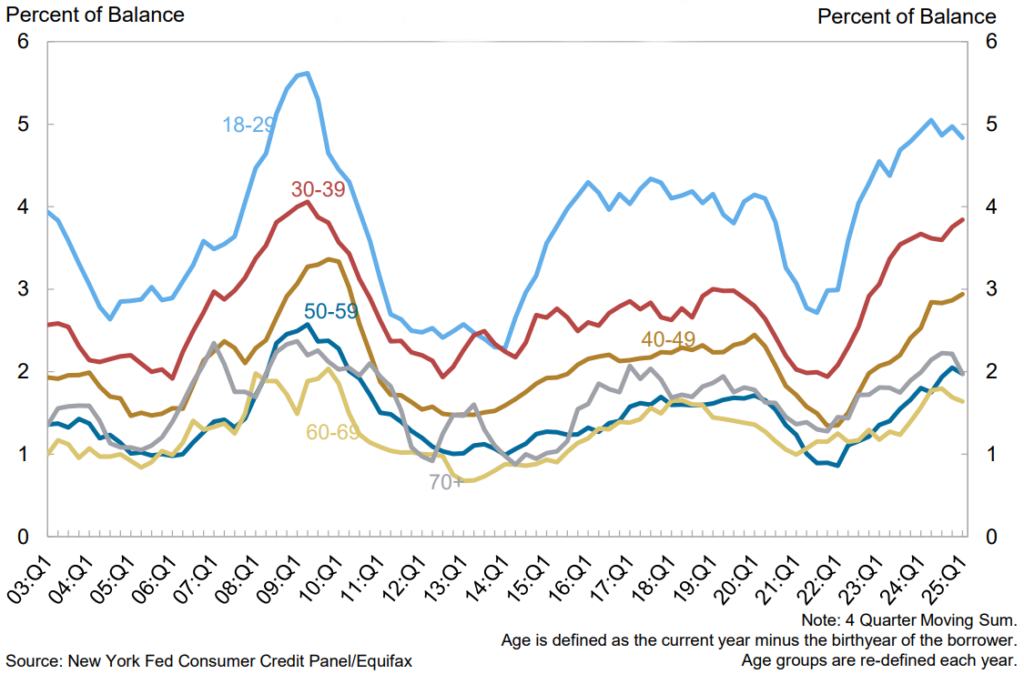

4. Borrower’s age and delinquency

When focusing on serious late or late delinquency, where you are more than three months late on car loan payments, it is difficult to challenge borrowers of all ages who are lagging behind in the rate of increase.

Borrowers in their 20s are more than twice as likely as older people, but they can see trendlines that are rising across all generations. New York Fed’s quarterly household debt and credit report for May 2025.

I understand, but what has caused so many car owners to be delinquent?

The experts we interviewed and the research we highlight points to four factors:

1. High vehicle prices

| Average loan amount (4th quarter 2020) | Average loan amount (4th quarter 2024) | Why does it hurt |

|---|---|---|

|

New car: $36,246 Used cars: $22,444 |

new: $42,023 Used: $26,135 |

Your dollars are not dealers, car lots, or private party deals. |

| Source: Transunion |

Returning to 2017, the automaker began trimming cars under $25,000 from the lineup and increasing the number of cars built above the price of more than $60,000. If all (manufacturers) do so, there is only this majority of the underserved market. With cheap cars, many people were forced to buy something more expensive than they wanted, as the cheaper cars actually no longer existed.

– Shawn Tucker, lead editor for Kelley Blue Book

2. Interest rates rise

| Average APR (4th quarter 2020) | Average APR (4th quarter 2024) | Why does it hurt |

|---|---|---|

|

new: 8.5% Used: 4.3% |

new: 11.8% Used: 6.5% |

Each month, I have an overall interest in lenders. |

| Source: Transunion |

Despite a relatively healthy labor market, the recent rise in late arrears over the past four quarters is an early indication that certain consumers are under stress from rising costs of living on floating consumer debt such as credit cards and rising interest rates.

– Anthony Tran, Vice President of Ratings for North American Financial Institutions

3. Monthly payments inflation

| Monthly membership fees | Transunion says that since the end of 2019, average membership fees have increased by more than 30%, while inflation has increased by around 23%. |

Obviously, if you last bought a car five years ago, your monthly payments were $450, $500, and now it was $740. Therefore, it had a ripple effect on the increase in delinquency.

– Experian Head of Automotive Insights Melinda the Blitzky

4. Other inflationary pressures

One way to think about it: Affordable Crisis for Car Buyers It’s a crisis of delinquency for car owners. After all, the cost of a vehicle (see prices above) is just one line item in your budget. Even after you drive the lot, inflation can empty your wallet.

actual, Latest inflation statistics Gas prices show that they are about 20% higher than before the pandemic. Additionally, other car maintenance costs include:

| 2024 and increased costs | Increase in costs in 2020 | |

|---|---|---|

| insurance | 6.4% | 55.3% |

| Automatic repair | 7.6% | 56.8% |

As Jonathan Smoke, Chief Economist of Cox Automotive, reminds us, your income probably doesn’t correspond to the inflation of these cost of ownership.

“Many (borrowers) were on loan in 2022 and 2023 when the prices of new and used vehicles were at an absolute peak,” Smoke says. “Then, inflation takes off and for most of almost two and a half years, inflation generates negative income situations. That is, while revenues are rising, that is, with good clips by historical standards – unfortunately, inflation has become even higher.”

What does this mean to you?

As Smoke says, a way out of the ongoing rise in car loan delinquency is “to see consumers improve their financial position.”

And it can happen very often. in the case of Impending trade war It won’t happen if there is Customs If it turns out to be more ferocious than real and the labour market remains stable (at least for those employed), income should reduce inflation.

But that might make little sense if you’re already at the edge of delinquency.

“When there’s a ton of negative equity, your options are more limited when you run into financial challenges,” Smoke says. “It’s hard for lenders to find a way to work with you on a loan, and you don’t have a great alternative Selling the vehicle and Trade Down If the vehicle is borrowing more than worth it, then go for something small. ”

That being said, let’s consider these tips.

How to avoid car loan delinquency

- Stay in touch with your lender. If you feel like you are There is a risk of missing monthly paymentscontact your lender as soon as possible. Most lenders prefer to avoid vehicle retrieval, so they track financial documents and maintain a line of communication.

- Request a change of loan. Change the loan In Get a lower car payment It helps lenders avoid foreclosure-related costs. You may be able to postpone some payments or shift semesters to fit your budget. However, not all lenders provide it Car Loan Difficulty Program.

- Work to pay off the loan. Keeping up with payments may help you Avoid seizing. This can be one of the most challenging approaches, but it can be dramatically helpful if you have space on your budget.

- Sell the car. If you can’t afford monthly payments, selling your vehicle is another way to end your loan. Before choosing this route, make sure you do not turn the loan upside down. If you owe more than your car, I’ll exchange it It is also rarely an option.

- Consider refinancing. Change the loan Get a better rate Or you can lower your monthly payments for the period. But if you missed many payments or if it’s the default, you probably won’t qualify Refinance.

- I’ll surrender your car. If you can no longer pay a vehicle known as voluntary foreclosure, you may choose to abandon the vehicle. Unfortunately, it still has a negative effect on your credits. But if you maintain open communication with your lender, it may be more willing to write Goodwill letter It can minimize harm to your credits.