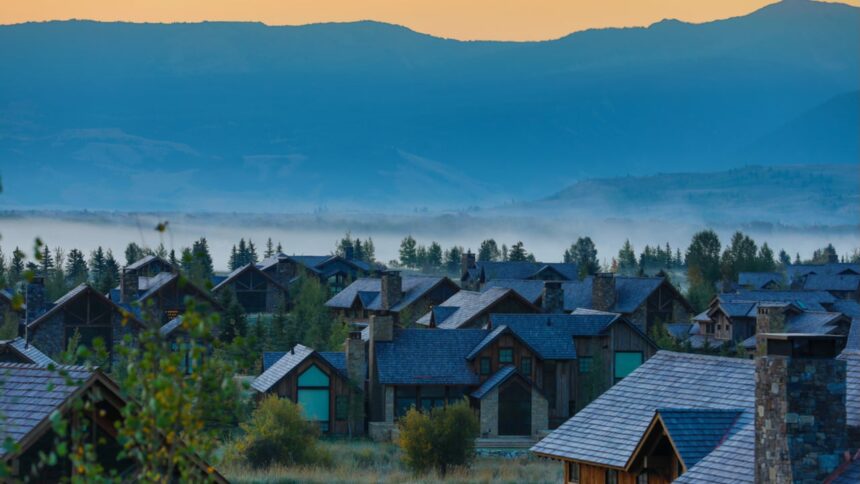

Nicole Glass Photo/Shutterstock

Buy your first home It is a major financial effort, and down payments and closing costs can be a huge hurdle. Good news? If you’re looking for a home in Wyoming, the Wyoming Community Development Authority can connect you with an affordable mortgage Down payment support To make homeownership more accessible. It can also combine some of the program with the agency’s first-time homebuyer loans. This helps lower the barrier even further.

Wyoming’s first home buyer program

WCDA Standard First Home Buyer Program

The Wyoming Community Development Agency (WCDA) standard first home buyer program offers a 30-year mortgage at a fixed, low rate, along with the option of down payment assistance loans. First-time home buyers are considered to be people who have not owned a home in the past three years, but can obtain an FHA, VA, or USDA loan through the program.

To qualify, the home you are purchasing must have a program price limit ($510,939 in most areas, but $1,179,090 in Teton County) and an income limit, which depends on the county and household size.

WCDA Spruce Up Program

WCDA’s Spruce Up Program offers all mortgages and rehabilitation loans. I’ll fix it. These costs include creating unstructured repairs, replacing HVAC or electrical systems, and even renovations to improve accessibility.

The amount of this loan cannot exceed the WCDA price limit and the eligibility requirements are the same as those of the standard First Home Buyer Program.

HFA Priority Loan

WCDA also has access to first-time repeat home buyers to Fannie Mae HFA preferred traditional loans. These are 30-year mortgages with no purchase price restrictions. However, to qualify, you must meet county and household size income restrictions.

Wyoming down payment support

WCDA Home Stretch Down Payment Support (DPA)

This Down Payment Assistance Assistance (DPA) loan via WCDA, stylized as “Home $Tretch,” allows you to borrow up to $15,000 without interest (though you may have to pay a fee), and without monthly payments. No loans are scheduled unless you sell your home, refinance, or pay off your initial mortgage. It can be combined with standard first-time home buyers and spruce uploan programs.

You will need a $1,500 borrower’s donation, but this can be raised from gifts rather than your own funds. You also need a minimum credit score of 620.

WCDA amortizes DPA

WCDA amortized DPA loans (up to $15,000) can be combined with HFA priority and advantage mortgages. This loan has a low fixed interest rate and requires you to pay it back over a decade. Like the Homestretch DPA loan, you will have a minimum credit score of 620 and you will need to give at least $1,500 to qualify.

Other Wyoming Home Buyer Support Programs

Mortgage Credit Certificate (MCC)

a Mortgage credit certificate (MCC) is the first home buyer tax credit based on annual mortgage interest. You can use this credit throughout your mortgage lifetime. This could be comparable to 20-40% of annual mortgage interest. The exact amount you qualify for depends on your income and individual tax situation. More specifically, According to the WCDA:

- For qualification loans under $125,000, the MCC rate is 40%

- For qualified loans of $125,001 or more, the MCC rate is 30%

- For qualified loans of $200,001 or more, the MCC rate is 20%

If your MCC rate is above 20%, your credit amount will be $2,000. There is no maximum at low rates.

To qualify, you must meet the definition of a first-time home buyer (no homes have been owned in the last three years) and be within the WCDA purchase price and income limits.

If you are getting a mortgage through WCDA, you cannot combine MCC with a standard first-time home buyer and spruce-up program, but you can combine it with HFA priority loans or advantage loans.

Other Wyoming’s first home buyer loan

If you are your first homebuyer in Wyoming, consider exploring others Low and unpaid payment mortgageFHA, VA, USDA loans, etc. are offered at lower interest rates and provided by many mortgage lenders.

-

FHA Loan: The Federal Housing Administration (FHA) provides insurance, FHA Home Loan Low credit score and down payment requirements.

- VA Loan: VA mortgages are guaranteed by the U.S. Department of Veterans Affairs. These mortgages are available to active service members, veterans, and surviving spouses and include several benefits, including down payments and private mortgage insurance (PMI) requirements. Additionally, VA loan fees often tend to be lower than traditional loan loans.

- USDA Loan: USDA’s mortgage program is designed to support low- and middle-income buyers in some rural areas. The program is guaranteed by the US Department of Agriculture.

There are other specialized programs as well. Good neighbor next door The program supports home buyers working in certain occupations, such as education.

Let’s get started

If you are interested in the program through the Wyoming Community Development Authority, please visit the organization’s website for a map of participating mortgage lenders who can help you get started with the mortgage process. The website also displays current interest rates and eligibility requirements and explains how to participate in a homebuyer education class.

Please shop together Multiple lenders Therefore, you can find the most competitive one Wyoming interest rates And the best terminology for your situation. You will also need to get used to the process of buying a home in Wyoming and other costs associated with the home buying process. Homeowner Insurance.

Head to Bankrate Guide for more information about the national program and what you might qualify for First Home Buyer Loan.