Stocks are forging one new high after another, lifted by optimism about the economy and stronger-than-expected earnings during the last quarter. Putting aside the stocks’ elevated vulnerability to short-term corrections after their fast run-up, the continuation of the rally hinges on the same factors it always does, economy and earnings. Let us dive into five central macro themes that should be closely watched, as they wield an enormous power over the stocks’ future direction.

Inflation and Jobs: RIP the Phillips Curve?

Most factors that brought on the inflation shock in 2021-22 were fully related to the Covid-19 crisis and its consequences. Thus, the pent-up demand for services exploded as we exited lockdowns, driving service prices higher, while the supply-chain disruptions propelled prices of goods upwards. At the same time, fiscal stimulus and near-zero interest rates provided the means for businesses and consumers to keep on rolling, despite the inflation.

A lot of things changed since then, and with the Fed’s aggressive tightening, prices have been decelerating fast. However, the latest CPI print has shown that it would be premature to declare a decisive victory, as there are some pockets of stubborn inflation stickiness, specifically in the shelter prices segment. “The last mile” of the inflation fight may prove lengthier than investors hoped, forcing the central bank to keep rates higher for longer.

Still, a single data point does little to change the prevailing view that inflation is firmly on its way toward the Federal Reserve’s 2% target. Market participants and policymakers are awaiting PCE inflation data due at end-month to shed more light on this assumption.

Source: Trading Economics

Meanwhile, it looks like the Fed scored high on its second mandate of maintaining the labor market stability. The Phillips Curve theory, which implies an inverse relationship between the job market and inflation, now seems obsolete. Even though inflation has been falling, the labor market has continued to display a picture of robust health, with hiring humming along happily and wages growing at higher rates than before the pandemic.

Source: Trading Economics

The job market’s strength does not necessarily mean an imminent “wage-price spiral,” i.e., upward pressures on prices from rising wages, thanks to strong labor productivity growth. However, nothing in this world is certain, and neither is continued disinflation. Price surges can still be rekindled by wage growth, services costs, or other factors. Policymakers continue to closely watch monthly inflation and labor data points, and we should, too.

Consumer Spending: Buying Growth

Consumer spending is the foundation of developed economies, and all the more so in the U.S., where household consumption comprises the highest percentage of GDP of all rich countries at 70%. The resilience of U.S. personal consumption has been astounding, given that even a short while ago many economists foresaw an imminent economic recession.

There have been worries about household debts because of high interest rates. However, households are as indebted now as they were before the Covid-19 crisis, while a continued increase in disposable personal income negates worries that high interest on debt will leave Americans with no means left for shopping. In fact, all categories of consumer loans – even credit card debt – make up a smaller proportion of disposable incomes now than before the pandemic. Moreover, while there is a gentle increase in delinquencies, these rise from the ultra-low floor, continuing to reflect a normalization back to pre-pandemic levels.

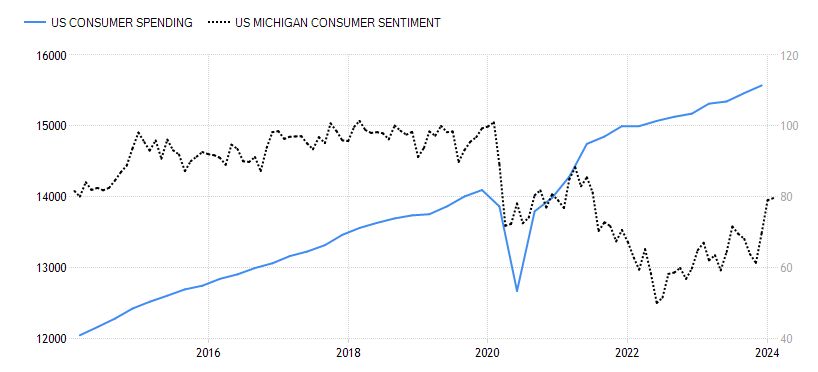

One of the most-used leading indicators for short-term trends in spending was the consumer sentiment index. However, in the post-pandemic era, it increasingly resembles a broken compass. While consumer confidence has been much lower than before the Covid-19 crisis, spending has been rising strongly throughout the economic uncertainty, which until now has proven the doomsayers wrong. With the consumer sentiment now rising strongly, we may soon leave this discrepancy for scholars of economic history to ponder about.

Source: Trading Economics

Still, while we should carefully avoid underestimating the resiliency of the American consumer, the feelings reflected in the sentiment surveys are often swayed by stock movements. The stock market rallies play a large role in the household perception of their wealth, and with the S&P 500 seemingly churning out records by the day, everyone is now feeling optimistic. However, we should watch out for signs of “irrational exuberance” which could rekindle inflation, among other things.

Economic Growth: Too Hot or Not?

Recession worries have receded, with the most notoriously bearish strategists scrambling to update their outlooks to fit the reality. No one is mentioning a recession in their outlook, with the overall consensus locked on the “Goldilocks” narrative: neither too hot nor too cold, just perfect. While this single-mindedness might be a tad scary, a contrarian would not find too much data to base a bear case on.

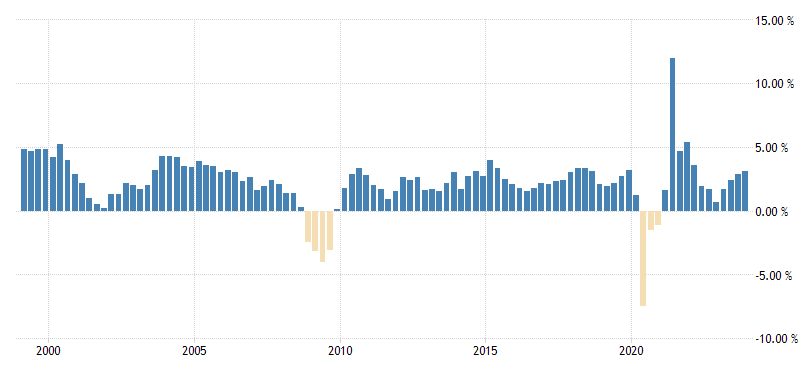

In fact, the same factors that led to a surge in inflation back in 2021-22, were responsible for the growth spikes post-pandemic, pushing the Fed into a tightening campaign. GDP growth slowed down significantly in 2022, reeling under the weight of rate hikes and the subsequent tightness of financial conditions, as well as the decline in economic sentiment on the back of heightened uncertainty. However, growth has been on a strong upward tilt in 2023, reaching its 75-year average of 3.1% in the last quarter.

Source: Trading Economics

However, true economists will always find a reason for concern. Growth forecasts have been moving higher lately, and, according to the Atlanta Fed’s “GDPNow” estimate, this quarter’s growth will reach 3.4%. Some components of the index, such as employment numbers, manufacturing and services growth, construction spending, and others, paint an even hotter outcome, while simultaneously lifting the inflation outlook, too.

So, while we enjoy this Goldilocks moment, we must acknowledge that a hotter-than-needed economy may lead to resurging inflation. If that happens, we may find ourselves in a situation where the Fed needs to induce a recession to squash inflation.

Federal Reserve: To Cut or Not to Cut?

Goldilocks got a little burned by the latest CPI inflation report, which came in too hot to fit the narrative. Although we shouldn’t focus too much on a single, albeit crucially important, data point, it shouldn’t be dismissed either.

Policymakers are in a tight spot, as underneath the surface of the economy’s ruddy health, different economic subsectors are impacted by high interest rates (at the moment, the worry du jour is regional banks’ exposure to the reeling commercial real estate market). Still, these pockets of distress are very local and easily manageable, presenting far lower risk than that of a premature cut reigniting inflation. History tells us that the economy will be much better off with higher rates lingering for a while, than with a cut followed by a spike in prices, which would lead to another hiking avalanche.

Further rate increases are out of the question unless the Fed’s favorite inflation gauge, the PCE, shifts strongly upward, or the economy shows concise signs of overheating. On the other hand, there is no immediate pressure to cut, given the robust labor market and consumer strength. Besides, the stock market rally leads to looser financial conditions and the money surging freely through the economy heats it up, counterweighing the central bank’s efforts. In short, policymakers want proof that inflation is tamed before they make their first cut. That’s going to take a while.

Corporate Earnings: AI Love U

One of the most important drivers of the stock-market rally has been corporate earnings, whose resiliency in the face of higher rates surprised analysts and economists.

The fact is that large corporations represented by the S&P 500 index locked in low-interest rates on their debt during the near-zero rates era, reducing the threat of high debt servicing costs. Coupled with various cost-cutting efforts and improved operating efficiencies, this has helped companies to counter elevated input prices, while expanding their profit margins. In addition, many large companies were able to pass higher costs on to their customers, reaching record profits along the way.

Building on these achievements, stocks of the SPX firms were further lifted by the Artificial Intelligence (AI) narrative, which took the world by storm. Besides all other expected effects, AI is anticipated to further increase corporate efficiency, considerably upping bottom lines for years to come. No wonder that the rally has been led by tech stocks, the drivers of the coming AI revolution, leading many to ponder about its similarity to the dot-com boom.

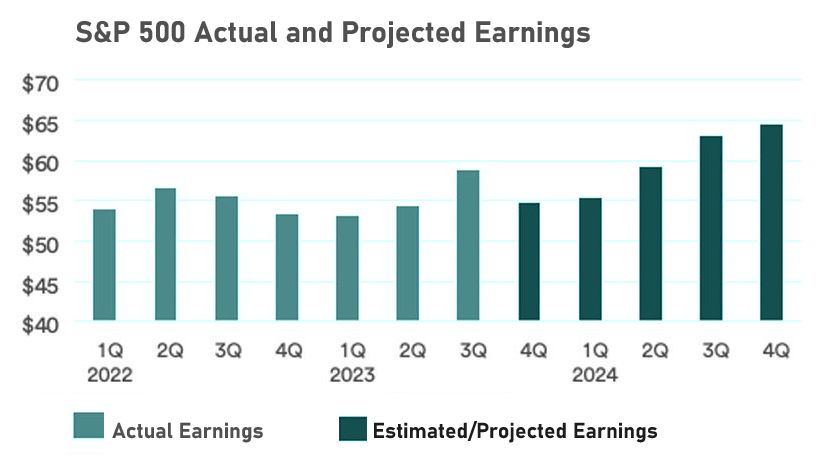

Source: FactSet

While it might be the case that the technology stocks have run ahead of themselves, numbers don’t lie; corporate earnings have been very strong and are slated to continue their upward march. Roughly three-quarters of the S&P 500 firms have reported their Q4 2023 results, with earnings up almost 6% year-on-year. However, the earnings positivity in the previous quarter was contributed by the megacap technology companies, while most other sectors’ earnings are expected to rebound only further along the road.

Analysts expect SPX earnings to increase by 10% in 2024, followed by 12% growth in 2025. However, outside of the tech megacaps, strong earnings growth remains in question, as it faces challenges from elevated interest rates, while economic growth is expected to moderate this year. In short, earnings will continue to be impacted by the economy and inflation – and, since earnings are the most important driver of stock prices, the stock market’s direction will hinge on economic performance. In short, stay tuned.