Tim Robbert/gettyimages; Illustrations by Hunter Newton/Bankrate

Capital One Credit Card Cash Advance is one way to get cash when you actually need it. Essentially, they borrow cash from the credit line and promise to repay it later.

Cash advance is rarely the best option due to high fees and even higher interest rates, but it can be useful in situations where you may not have enough money to cover the cash-only expenses.

Let’s look at how Capital One Cash Advances works and what to consider before requesting one, including a breakdown of fees related to Cash Advance.

What is Cash Advance?

Cash Advance allows you to retrieve cash from your credit card. Instead of using a credit card for your purchase, you can request a prepayment for your credit limit in cash. Most people use ATMs to get cash advances, but you can also request it within your bank branch.

Cash Advance allows you to access cash when credit cards are not accepted. For example, if you are purchasing postal money orders, you will need to pay in cash, and your debit card (or if you don’t have enough funds in your checking account to use your debit card) can provide the money you need.

However, it is generally better to get cash from a debit card or checking account than to request cash advance with a credit card. Cash Advance comes with fees and high interest rates, and cash Advance interest begins to accrue immediately after the transaction is completed.

If you are considering requesting cash advances, we recommend looking for a personal loan instead, as you will need to cover expenses that you cannot pay from your checking account. In many cases, personal loan fees are lower than cash advance fees. This means that a proper personal loan can save you a significant amount of money over time.

How to get cash advance in Capital 1

To get Capital 1 Credit Card Cash Advance, start by finding an ATM. ATMs outside Capital One One AllPoint Networks do not need to use ATMs outside Capital One Point Networks.

Follow three basic steps:

- Insert a single capital credit card into the ATM and enter the card pin.

- Select “Cash Advance” Options (may be required to select) “credit” beginning).

- Follow the instructions to request a cache advance.

If you want to create a cache advance but don’t have a pin, you can request it online by following these steps:

- Log in to one Capital account and select the credit card you want to use for cash advance.

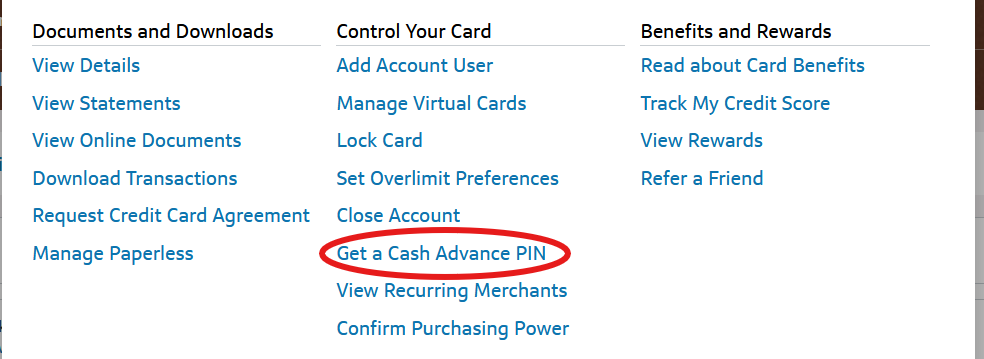

- Select “I want to…” A menu button with a gear icon next to it.

- Scroll to the (Card Control) section to select “Get a Cash Advanced pin.”

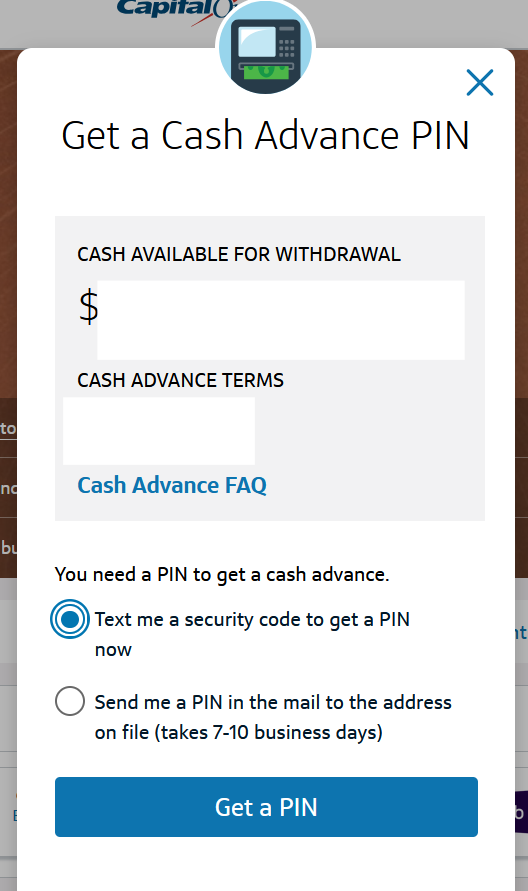

- Use your security code and mobile phone to get pins via email or choose to get them immediately.

- Select “Get the pins” Follow the rest of the instructions.

If you don’t want to deal with pins, try going to a bank branch. If you see a visa or Mastercard logo in your bank’s lobby, you should be able to take cash advances at the bank’s teller. All you need is a single capital credit card, such as a driver’s license, and a government-issued photo ID. Once the cash advance is complete, you will receive cash from your ATM or bank teller.

Things you need to know before getting cash advance

Cash advance can be useful in a pinch, but can be very expensive. Here’s what you need to know before getting a cache advance:

Which capital card offers cash advance?

Currently, all Capital One credit cards offer cash advances, including several popular cashback credit cards, travel credit cards and business credit cards.

This is a breakdown of cash advance fees and APRs associated with each card.

Conclusion

Getting cash advance from a Capital One card is a simple process. Especially since all capital cards allow cash advances and charge the same fee. If you’re ready for your PIN, you should be able to get cash advances in your ATM. If you need to request a PIN, the process becomes a little more complicated, but it’s easy to run online via your account. Alternatively, you can get the pin and access the bank and work with the Terror.

Be careful – Cash advances earned from your card will incur immediate cash advance fees and large APRs. This means your balance will start earning interest without a bounty period. So you should only get a cash advance if you know you can pay it off immediately.